Consider the following two earnings forecasting models: E,(EPS) is the expected forecast of earnings per share for

Question:

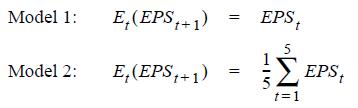

Consider the following two earnings forecasting models:

E,(EPS) is the expected forecast of earnings per share for year t+1, given informa- tion available at t. Model 1 is usually called a random walk model for earnings, whereas Model 2 is called a mean-reverting model. The earnings per share for Ford Motor Company for the period 1990 to 1994 are as follows:

Year 1990 1991 1992 1993 1994 EPS $0.93 $(2.40) $(0.73) $2.27 $4.97.

a. What would be the 1995 forecast for earnings per share for each model?

b. Actual earnings per share for Ford in 1995 were $3.58. Given this information, what would be the 1996 forecast for earnings per share for each model? Why do the two models generate quite different forecasts? Which do you think would better describe earnings per share patterns? Why?AppenidxLO1

Step by Step Answer:

Business Analysis And Valuation Using Financial Statements Text And Cases

ISBN: 9780324015652

2nd Edition

Authors: Krishna G. Palepu, Paul M. Healy, Victor Lewis Bernard, W.Gordon Filby