For the year 2010, the remeasurement component of Kensingtons periodic pension cost represents: A. the change in

Question:

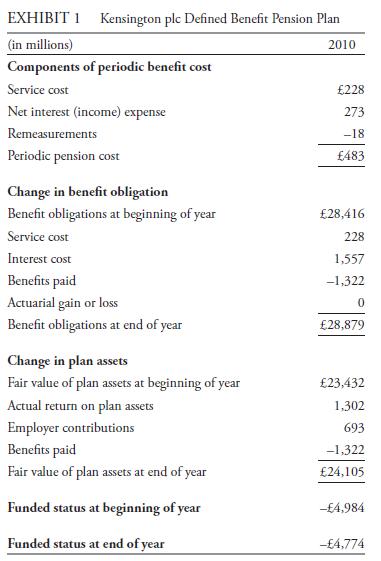

For the year 2010, the remeasurement component of Kensington’s periodic pension cost represents:

A. the change in the net pension obligation.

B. actuarial gains and losses on the pension obligation.

C. actual return on plan assets minus the amount of return on plan assets included in the net interest expense.

Kensington plc, a hypothetical company based in the United Kingdom, offers its employees a defined benefit pension plan. Kensington complies with IFRS. The assumed discount rate that the company used in estimating the present value of its pension obligations was 5.48 percent. Information on Kensington’s retirement plans is presented in Exhibit 1.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie