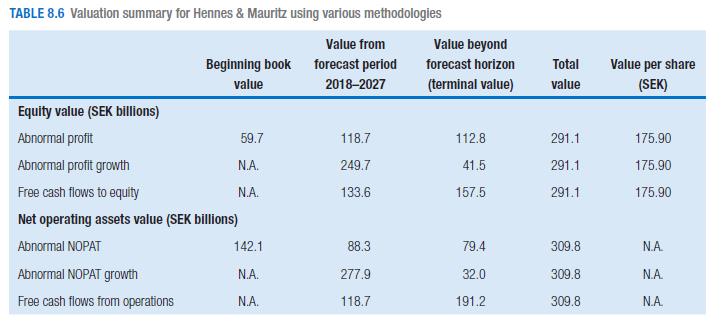

How will the terminal values in Table 8.6 change if the revenue growth rate in years 2028

Question:

How will the terminal values in Table 8.6 change if the revenue growth rate in years 2028 and beyond is 4 percent, and the company keeps forever its abnormal returns at the same level as in fiscal 2027 (keeping all the other assumptions in the table unchanged)? If revenue growth is 3 percent in 2027 and 4 percent in 2028, why are the equity value estimates of the free cash flow model and the abnormal profit model no longer the same?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu

Question Posted: