The companys effective tax rate was highest in: A. 2005. B. 2006. C. 2007. Note I Income

Question:

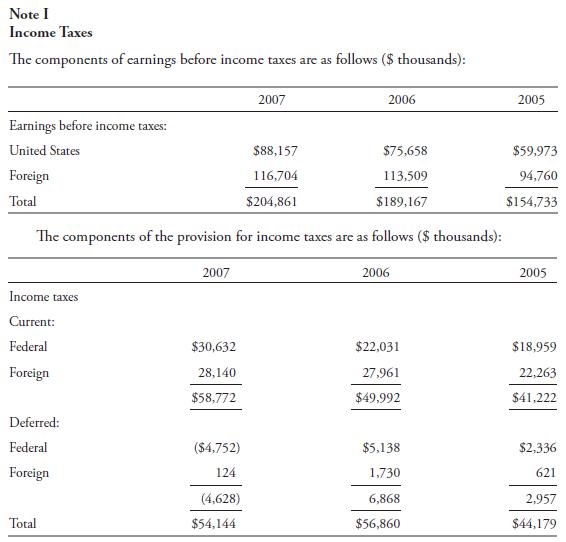

The company’s effective tax rate was highest in:

A. 2005.

B. 2006.

C. 2007.

Transcribed Image Text:

Note I Income Taxes The components of earnings before income taxes are as follows ($ thousands): Earnings before income taxes: United States Foreign Total Income taxes Current: Federal Foreign $88,157 $75,658 116,704 113,509 $204,861 $189,167 The components of the provision for income taxes are as follows ($ thousands): Deferred: Federal Foreign Total 2007 $30,632 28,140 $58,772 ($4,752) 124 (4,628) 2007 $54,144 2006 2006 $22,031 27,961 $49,992 $5,138 1,730 6,868 $56,860 2005 $59,973 94,760 $154,733 2005 $18,959 22,263 $41,222 $2,336 621 2,957 $44,179

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

To determine the companys effective tax rate for each year we would need to look ...View the full answer

Answered By

Amos Kiprotich

I am a wild researcher and I guarantee you a well written paper that is plagiarism free. I am a good time manager and hence you are assured that your paper will always be delivered a head of time. My services are cheap and the prices include a series of revisions, free referencing and formatting.

4.90+

15+ Reviews

21+ Question Solved

Related Book For

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie

Question Posted:

Students also viewed these Business questions

-

Weatherford International The oilfield services industry includes thousands of companies large and small that provide drilling, seismic testing, transportation, and a wide range of other services to...

-

Bryant Corporation was incorporated on December 1, 2006 and began operations one week later. Before closing the books for the fiscal year ended November 30, 2007, Bryant's controller prepared the...

-

Preparing journal entries for income tax expense. An athletic shoe company reports the following information about its income taxes for three recent years (amounts in millions): (a) Give the journal...

-

Kellogg Company is expected to pay $2.00 in annual dividends to its common shareholders in the future. Our best estimate of the expected cost of equity capital is 5.0% and the expected growth rate in...

-

What role does advertising puffery play in enforcing advertising regulations.

-

Discuss your favorite theme park with your class. Explain why it is your favorite. LO.1

-

If the opening inventory is 400 units, demand is 900 units, and production is 800 units, what will be the ending inventory? LO.1

-

Consider the drug treatment system shown in the figure below. A hemispherical cluster of unhealthy cells is surrounded by a larger hemisphere of stagnant dead tissue (species B), which is turn...

-

The S&P 500 Index price is $1975.12 and its annualized dividend yield is 2.20%. The annual LIBOR is 3.5% and is refered as the benchmark interest rate. Assuming annual compounding, how many futures...

-

Compared to the companys effective tax rate on US income, its effective tax rate on foreign income was: A. lower in each year presented. B. higher in each year presented. C. higher in some periods...

-

A company receives advance payments from customers that are immediately taxable but will not be recognized for accounting purposes until the company fulfills its obligation. The company will most...

-

EFN Define the following: S = Previous years sales A = Total assets D = Total debt E = Total equity g = Projected growth in sales PM = Profit margin b =Retention (plowback) ratio Show that EFN can be...

-

A 10 mm thick steel plate with dimensions of 10 x 10 cm and a density of 7.85 g/cm was submerged in seawater for a period of 1 year. During this period the weight of the plate reduced by 20 grams. Kw...

-

Consider the function f(x1,x2) = x 5x1x2 + 6x at the point x = (0, 2) and search direction p = (1, 1). 1. Write down the first-order Taylor approximation to f(x + ap), where a is the step size. 2....

-

Nike Company has hired a consultant to propose a way to increase the company\'s revenues. The consultant has evaluated two mutually exclusive projects with the following information provided for...

-

What are the most effective way to manage routine and catastrophic disasters, and are they different?

-

The Wall Street Journal reported that of taxpayers with adjusted gross incomes between and itemized deductions on their federal income tax return. The mean amount of deductions for this population of...

-

A total of 40,000 students on a university campus independently choose whether to go to the dining hall for dinner each day. Each student has dinner there, on a given day, with probability 0.84. a....

-

Huntingdon Capital Corp. is a competitor of Plazacorp and First Capital Realty. Huntingdon reported the following selected information (in millions):...

-

Which category of ratios is useful in assessing the capital structure and long-term solvency of a firm? (a) Liquidity ratios. (b) Activity ratios. (c) Leverage ratios. (d) Profitability ratios

-

What do liquidity ratios measure? (a) A firms ability to meet cash needs as they arise. (b) The liquidity of fixed assets. (c) The overall performance of a firm. (d) The extent of a firms financing...

-

Which of the following is not a tool or technique used by a financial statement analyst? (a) Common-size financial statements. (b) Trend analysis. (c) Random sampling analysis. (d) Industry...

-

You would like to have a balance of $600,000 at the end of 15 years from monthly savings of $900. If your returns are compounded monthly, what is the APR you need to meet your goal?

-

Explain the importance of covariance and correlation between assets and understanding the expected value, variance, and standard deviation of a random variable and of returns on a portfolio.

-

On August 1 , 2 0 2 3 , Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first month of operations: Aug. 1 Purchased...

Study smarter with the SolutionInn App