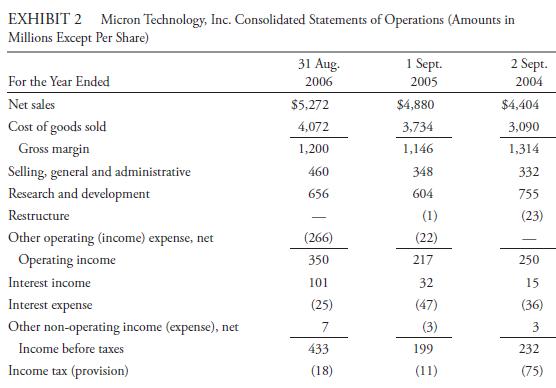

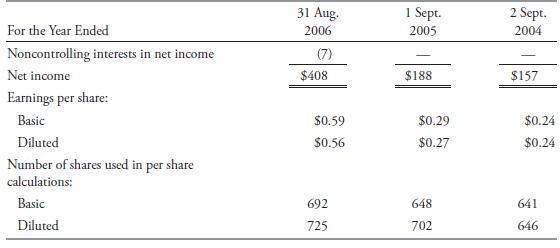

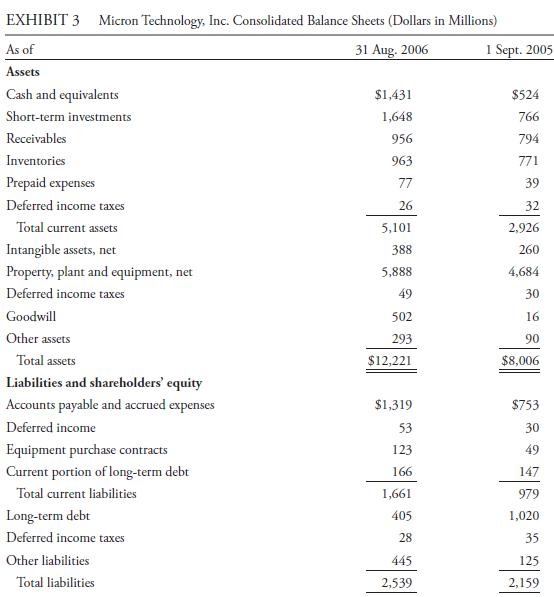

Use the financial statement information and disclosures provided by MU in Exhibits 2 , 3 , and

Question:

Use the financial statement information and disclosures provided by MU in Exhibits 2 , 3 , and 4 to answer the following questions:

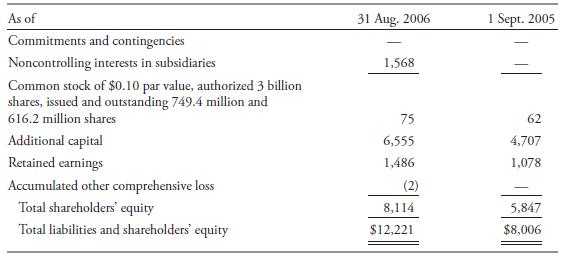

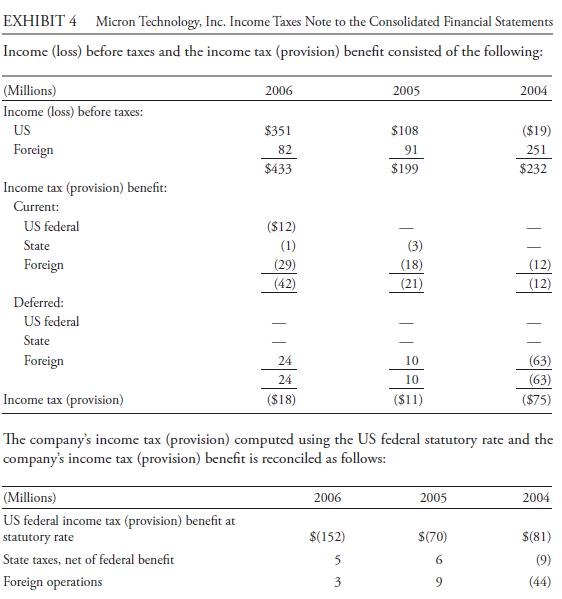

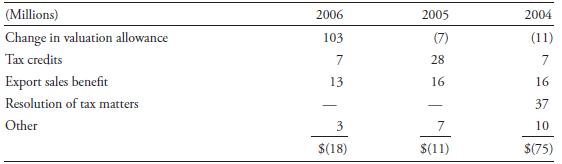

1. MU discloses a valuation allowance of $915 million (see Exhibit 4) against total deferred assets of $1,547 million in 2006. Does the existence of this valuation allowance have any implications concerning MU’s future earning prospects?

2. How would MU’s deferred tax assets and deferred tax liabilities be affected if the federal statutory tax rate was changed to 32 percent? Would a change in the rate to 32 percent be beneficial to MU?

3. How would reported earnings have been affected if MU were not using a valuation allowance?

4. How would MU’s $929 million in net operating loss carryforwards in 2006 (see Exhibit 4 ) affect the valuation that an acquiring company would be willing to offer?

5. Under what circumstances should the analyst consider MU’s deferred tax liability as debt or as equity? Under what circumstances should the analyst exclude MU’s deferred tax liability from both debt and equity when calculating the debt-to-equity ratio?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie