Arbortech, a designer, manufacturer, and marketer of PC cards for computers, printers, telecommunications equipment, and equipment diagnostic

Question:

Industry and Products Digital computing and processing have expanded now to include a broad array of mobile applications, including tablets, laptops, cell phones, digital cameras, and medical and automobile diagnostic equipment. A PC card is a rugged, lightweight, credit-card-sized device inserted into a dedicated slot in these products that provides programming, processing, and storage capabilities provided on hard drives in conventional desktop computers. The PC card has a high shock and vibration tolerance, low power consumption, a smaller size (relative to previous technologies), and a high access speed. At the time, the market for PC cards was one of the fastestgrowing segments of the electronics industry.

Arbortech designs PC cards for four principal industries: (1) communications (routers, cell phones, and local-area networks), (2) transportation (vehicle diagnostics and navigation), (3) mobile computing (handheld data collection terminals and notebook computers), and (4) medical (blood gas analysis systems and defibrillators). The firm targets its engineering and product development, all of which it conducts in-house, to these four industry groups. It works closely with original equipment manufacturers (OEMs) to design PC cards that meet specific needs of products aimed at these four industries. Arbortech also conducts its manufacturing in-house, which allows it to respond quickly to changing requirements and schedules of these OEMs. The firm markets its products using its own salesforce.

In Year 4, Arbortech was incorporated in Delaware. The firm made its initial public offering of common stock (1 million shares) on April 19, Year 4, at a price of $5.625 per share. Each common share issued included a redeemable common stock purchase warrant that permitted the holder to purchase one share of the firm's common stock for $7.20. Prior to its initial public offering, Arbortech obtained a $550,000 bridge loan during Year 4, which it repaid with proceeds from the initial public offering. Holders of the stock purchase warrants exercised their options during Year 5 and Year 6. The firm obtained equity capital during Year 5 as a result of a private placement of its common stock at $5.83 a share. It issued additional shares to the public during Year 6 at $18 a share. Its stock price was $5.25 on June 30, Year 4; $22.625 on June 30, Year 5; $29.875 on June 30, Year 6; and $52 on December 31, Year 7.

Arbortech maintained a line of credit throughout Year 4 to Year 6 with a major Boston bank to finance its accounts receivables and inventories. The borrowing was at the bank's prime lending rate. Substantially all of the assets of the firm collateralized this borrowing.

The firm's chief executive officer, Daniel James, is also its major shareholder. The firm maintains an employment agreement with James under which it pays his compensation to a Swiss executive search firm, which then pays James.

Beginning in Year 6, Arbortech made minority investments in five corporations engaged in technology development, four of which the firm accounts for using the cost method and one of which it accounts for using the equity method. Products developed by these companies could conceivably use PC cards. Arbortech also advanced amounts to some of these companies using interest-bearing notes.

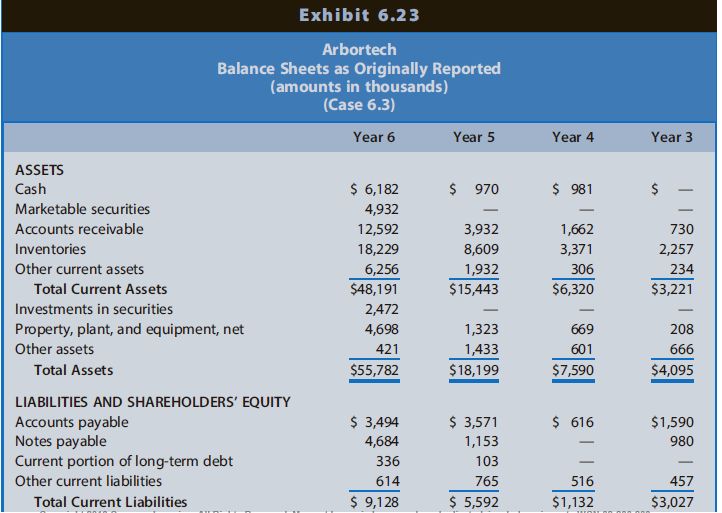

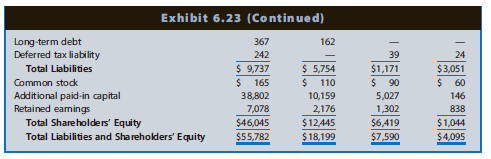

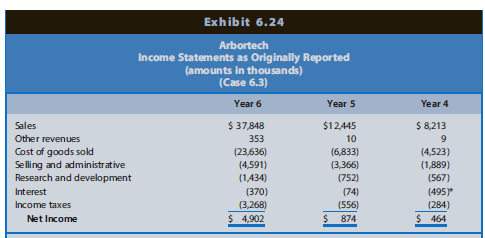

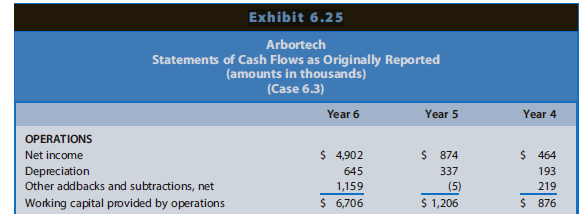

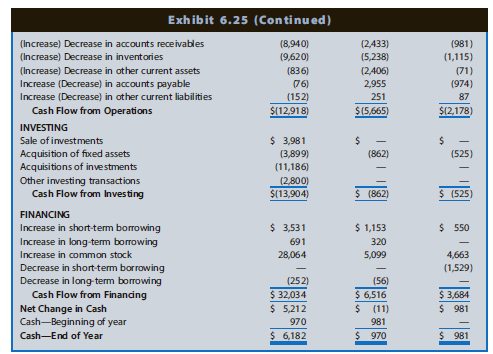

Exhibits 6.23 to 6.25 present Arbortech's financial statements for the fiscal years ended June 30, Year 4, Year 5, and Year 6, based on the amounts originally reported for each year.

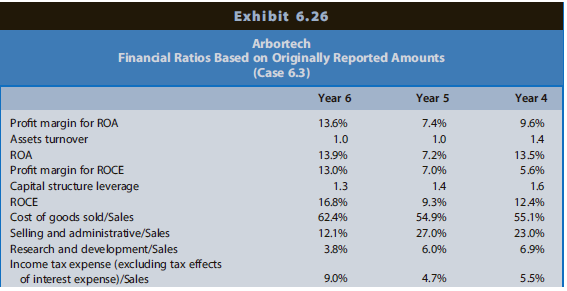

Exhibit 6.26 presents selected financial statement ratios based on these reported amounts.

Financial Statement Irregularities On February 10, Year 7, after receiving information regarding various accounting and reporting irregularities, the board of directors fired James and relieved the chief financial officer of his duties. The board formed a special committee of outside directors to investigate the purported irregularities, obtaining the assistance of legal counsel and the firm's independent accountants.

On February 21, Year 7, the New York Stock Exchange announced the suspension of trading in the firm's common stock. The stock was delisted on April 25, Year 7. On February 14, Year 7, the major Boston bank providing working capital financing notified the firm that the firm had defaulted on its line of credit agreement. Although this bank subsequently extended the line of credit through July 31, Year 7, it increased the interest rate significantly above prime. Arbortech decided to seek a new lender.

The investigation by the board's special committee revealed the following accounting and reporting irregularities:

- Recording of invalid sales transactions: The firm created fictitious purchase orders from regular customers using purchase order forms from legitimate purchase transactions. The firm then purportedly shipped empty PC card housings to these customers at bogus addresses. James apparently paid the accounts receivable underlying these sales with his personal funds.

- Recording of revenues from bill and hold transactions: The firm kept its books open beyond June 30 each year and recorded as sales of each year products that were shipped in July and should have been recorded as revenues of the next fiscal year.

- Manipulation of physical counts of inventory balances and inclusion of empty PC card housings in finished goods inventories.

- Failure to write down inventories adequately for product obsolescence.

- Inclusion of certain costs in property, plant, and equipment that the firm should have expensed in the period incurred.

- Inclusion in advances to other technology companies of amounts that represented prepaid license fees. The firm should have amortized these fees over the license period. Failure to provide adequately for uncollectible amounts related to advances to other technology companies.

- Failure to write down or write off investments in other technology companies when their market value was less than the cost of the investment.

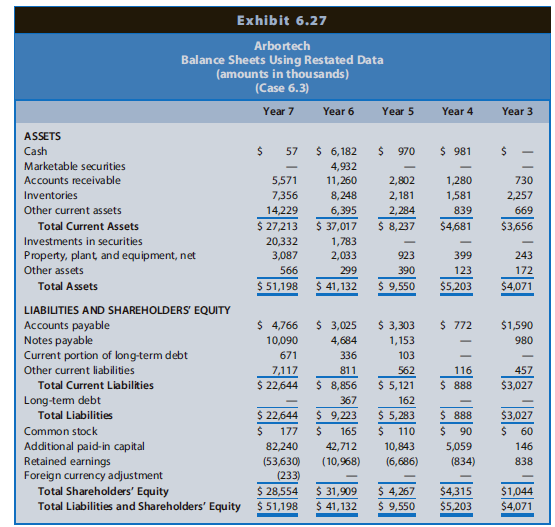

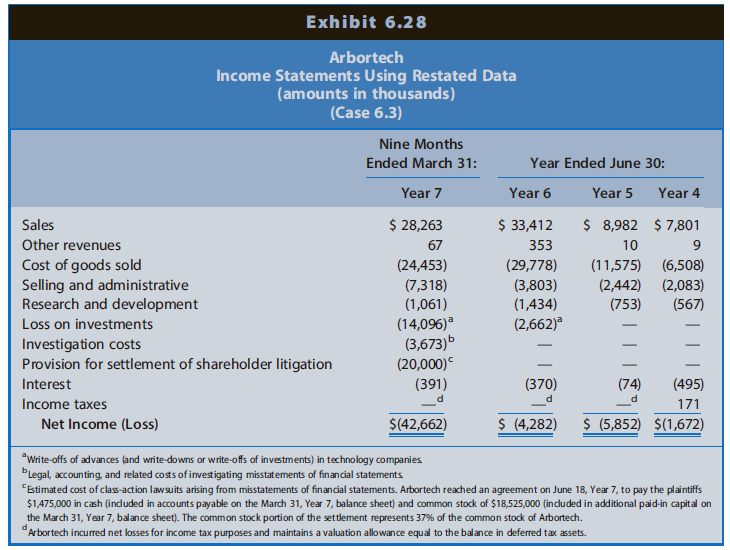

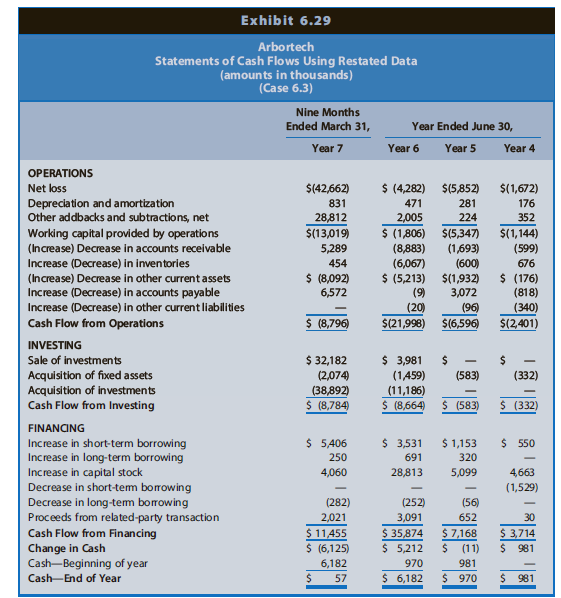

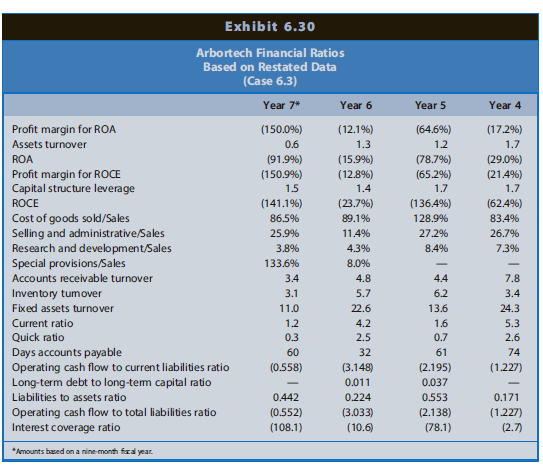

Exhibits 6.27 to 6.29 present Arbortech's restated financial statements for the fiscal years ending June 30, Year 4, Year 5, and Year 6, after correcting for the irregularities. These exhibits also present the financial statements for the nine months ended March 30, Year 7. The firm decided during February of Year 7 to change its fiscal year to a March year-end. Exhibit 6.30 presents selected financial ratios based on the restated financial statements.

REQUIRED

a. Using information in the financial statements as originally reported in Exhibits 6.23 to 6.25, compute the value of Beneish's Manipulation Index for fiscal Year 5 and Year 6.

b. Using information from Requirement a and the financial ratios in Exhibit 6.26, indicate possible signals that Arbortech might have been manipulating its financial statements.

c. Describe the effect of each of the eight accounting irregularities on the balance sheet, income statement, and statement of cash flows.

d. Using information in the restated financial statements in Exhibits 6.27 to 6.29, the financial ratios in Exhibit 6.30, and the information provided in this case, as a commercial banker, would you be willing to offer Arbortech a line of credit as of July 31, Year 7? If so, provide the conditions that would induce you to offer such a line of credit.

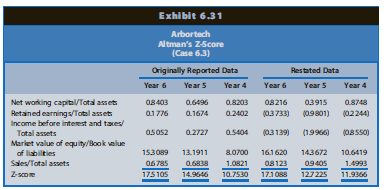

e. Exhibit 6.31 presents the values of Altman's Z-score for fiscal Year 4, Year 5, and Year 6 based on the originally reported amounts and the restated amounts. Compute the value of Altman's Z-score for the fiscal year ended March 31, Year 7. Although this is not technically correct, use the income amounts for the nine-month period ending March 31, Year 7. Based on the amounts in the proposed settlement of the class-action lawsuits, the value of the common equity on March 31, Year 7, is $50,068,568.

f. Can Arbortech avoid bankruptcy as of mid-Year 7? Explain. Why doesn't the Altman model signal the financial difficulties earlier?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Financial Ratios

The term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,... Line of Credit

A line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw