Question: Daktronics included this statement in its 2005 annual report: Required a. Compute the following for 2005 and 2004: 1. Net profit margin 2. Total asset

Daktronics∗ included this statement in its 2005 annual report:

Required

a. Compute the following for 2005 and 2004:

1. Net profit margin 2. Total asset turnover (use year-end assets)

3. Return on assets (use year-end assets)

4. Operating income margin 5. Return on operating assets (use year-end assets)

6. Sales to fixed assets (use year-end fixed assets)

7. Return on investment (use year-end balance sheet accounts)

8. Return on total equity (use year-end equity)

9. Return on common equity (use year-end common equity)

10. Gross profit margin

b. Comment on the trends in (a).

The accompanying notes are an integral part of these consolidated financial statements.

Required

a. Compute the following for 2004 and 2003:

1. Net profit margin 2. Total asset turnover (use year-end total assets)

3. Return on assets (use year-end total assets)

4. Operating income margin 5. Return on operating assets (use year-end operating assets)

6. Sales to fixed assets (use year-end fixed assets)

7. Return on investment (use year-end long-term liabilities & equity)

8. Return on total equity (use year-end total equity)

9. Gross profit margin

b. Comment on the trends in (a).

c. 1. Prepare a horizontal common-size consolidated statement of operations for 2002–2004. Use 2002 as the base.

2. Comment on the results in (1).

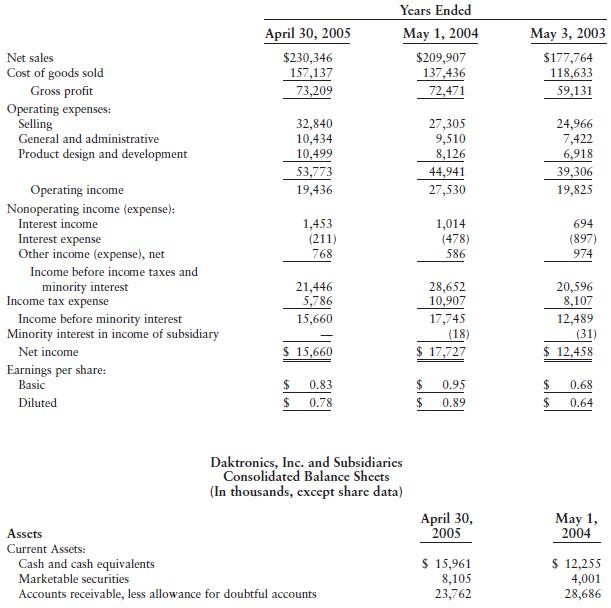

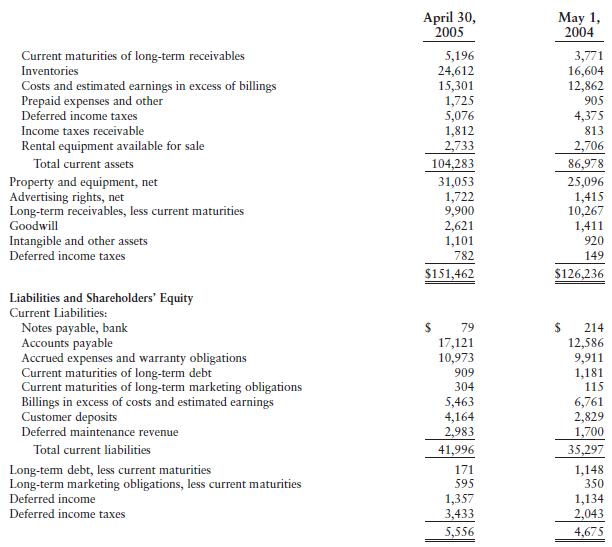

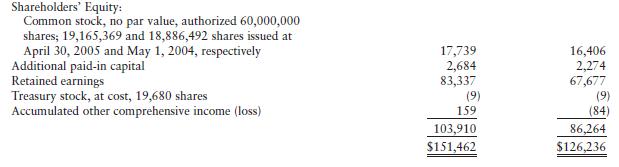

Years Ended April 30, 2005 Net sales $230,346 May 1, 2004 $209,907 Cost of goods sold 157,137 137,436 May 3, 2003 $177,764 118,633 Gross profit 73,209 72,471 59,131 Operating expenses: Selling 32,840 27,305 24,966 General and administrative 10,434 9,510 7,422 Product design and development 10,499 8,126 6,918 53,773 44,941 39,306 Operating income 19,436 27,530 19,825 Nonoperating income (expense): Interest income 1,453 1,014 694 Interest expense (211) (478) Other income (expense), net 768 586 (897) 974 Income before income taxes and minority interest 21,446 28,652 20,596 Income tax expense 5,786 10,907 Income before minority interest 15,660 17,745 8,107 12,489 Minority interest in income of subsidiary (18) (31) Net income $ 15,660 $ 17,727 $ 12,458 Earnings per share: Basic $ 0.83 $ 0.95 $ 0.68 Diluted $ 0.78 $ 0.89 $ 0.64 Assets Current Assets: Cash and cash equivalents Marketable securities Daktronics, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share data) Accounts receivable, less allowance for doubtful accounts April 30, 2005 May 1, 2004 $ 15,961 8,105 23,762 $ 12,255 4,001 28,686

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts