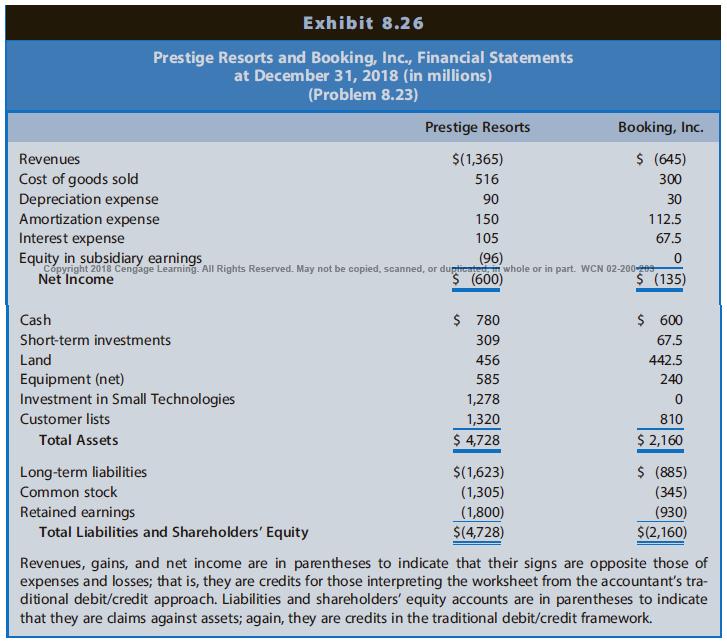

Exhibit 8.26 presents the separate financial statements at December 31, 2018, of Prestige Resorts and its 80%-owned

Question:

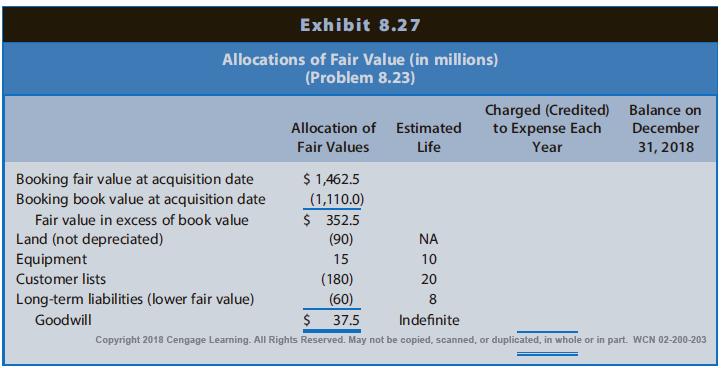

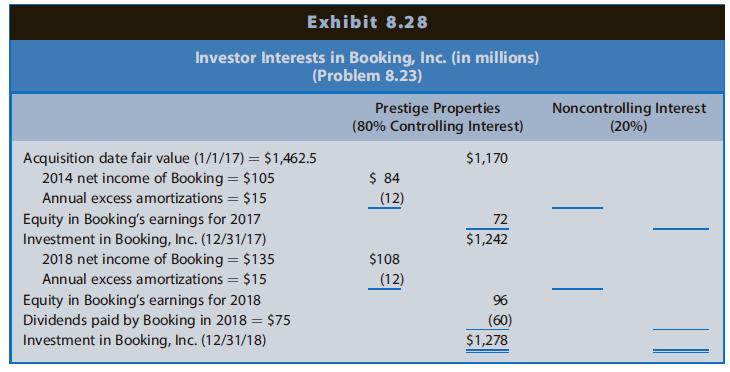

Exhibit 8.26 presents the separate financial statements at December 31, 2018, of Prestige Resorts and its 80%-owned subsidiary Booking, Inc. Two years earlier on January 1, 2017, Prestige acquired 80% of the common shares of Booking for $1,170 million in cash. Booking’s 2017 net income was $105 million, and Booking paid no dividends in 2017. Booking’s 2018 income was $135 million, and it paid $75 million in dividends on common stock during 2018. Booking’s pre- and postacquisition stock prices do not support the existence of a control premium. Exhibit 8.27 shows the allocation of fair value at the date of acquisition, January 1, 2017. Exhibit 8.28 traces Prestige Resorts’ equity method accounting for Booking, Inc. Ignore deferred tax effects.

REQUIRED

a. Complete Exhibit 8.27 to show income effects and balance sheet adjustments to be reflected in the December 31, 2018, Eliminations column of the consolidated worksheet.

b. Complete Exhibit 8.28 to trace the noncontrolling interests in Booking, Inc.’s earnings and net assets.

c. Prepare a worksheet to consolidate Prestige and Booking at December 31, 2018.

Exhibit 8.26

Exhibit 8.27

Exhibit 8.28

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw