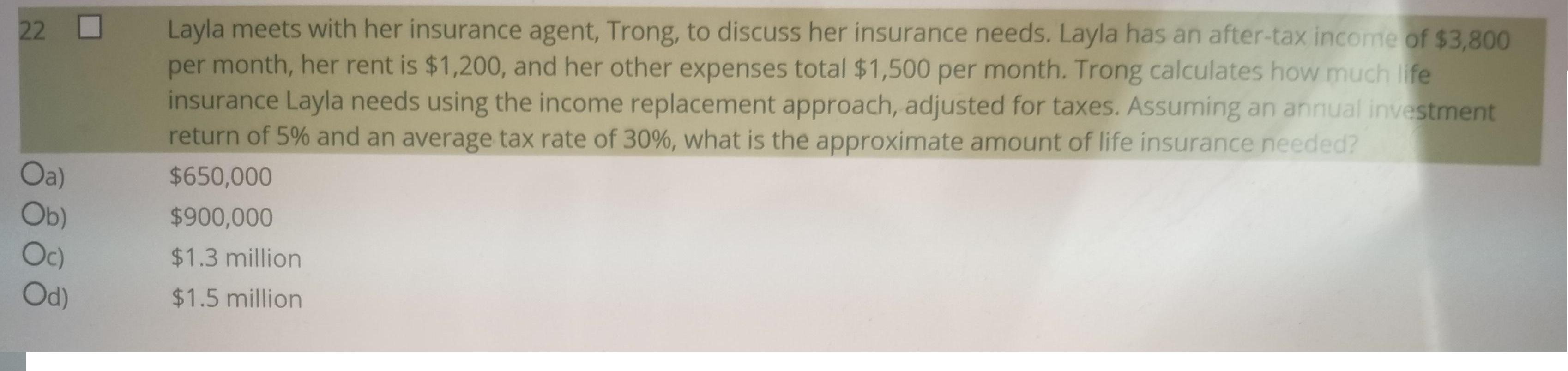

Question: Layla meets with her insurance agent, Trong, to discuss her insurance needs. Layla has an after-tax income of $3,800 per month, her rent is

Layla meets with her insurance agent, Trong, to discuss her insurance needs. Layla has an after-tax income of $3,800 per month, her rent is $1,200, and her other expenses total $1,500 per month. Trong calculates how much life insurance Layla needs using the income replacement approach, adjusted for taxes. Assuming an annual investment return of 5% and an average tax rate of 30%, what is the approximate amount of life insurance needed? 22 0 Oa) $650,000 Ob) $900,000 Oc) $1.3 million Od) $1.5 million

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Total monthly expens... View full answer

Get step-by-step solutions from verified subject matter experts