Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with this. The purpose of this case study is to help you integrate the managerial accounting concepts that were covered in class and

Need help with this.

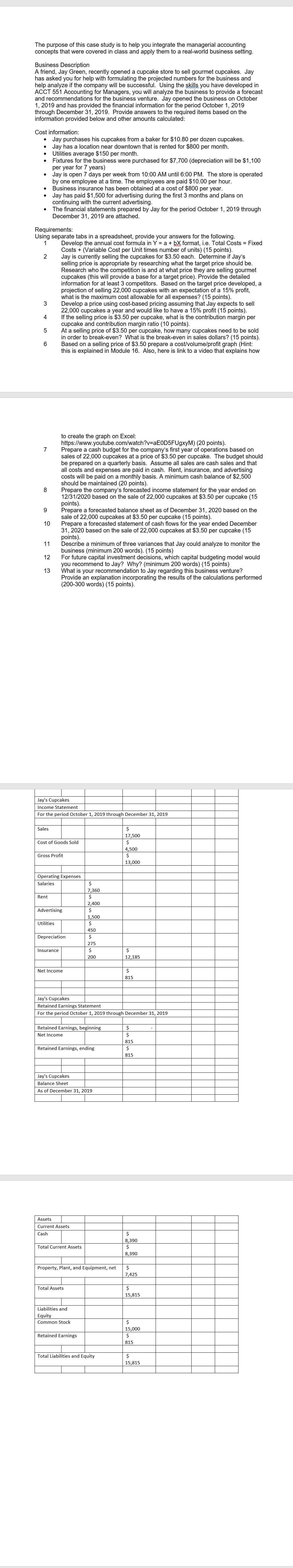

The purpose of this case study is to help you integrate the managerial accounting concepts that were covered in class and apply them to a real-world business setting. Business Description A friend, Jay Green, recently opened a cupcake store to sell gourmet cupcakes. Jay has asked you for help with formulating the projected numbers for the business and help analyze if the company will be successful. Using the skills you have developed in ACCT 551 Accounting for Managers, you will analyze the business to provide a forecast and recommendations for the business venture. Jay opened the business on October 1, 2019 and has provided the financial information for the period October 1, 2019 through December 31, 2019. Provide answers to the required items based on the information provided below and other amounts calculated: Cost information: Jay purchases his cupcakes from a baker for $10.80 per dozen cupcakes. Jay has a location near downtown that is rented for $800 per month. Utilities average $150 per month. Fixtures for the business were purchased for $7,700 (depreciation will be $1,100 per year for 7 years) Jay is open 7 days per week from 10:00 AM until 6:00 PM. The store is operated by one employee at a time. The employees are paid $10.00 per hour. Business insurance has been obtained at a cost of $800 per year. Jay has paid $1,500 for advertising during the first 3 months and plans on continuing with the current advertising. The financial statements prepared by Jay for the period October 1, 2019 through December 31, 2019 are attached. Requirements: Using separate tabs in a spreadsheet, provide your answers for the following. Develop the annual cost formula in Y = a + bX format, i.e. Total Costs = Fixed Costs + (Variable Cost per Unit times number of units) (15 points). Jay is currently selling the cupcakes for $3.50 each. Determine if Jay's selling price is appropriate by researching what the target price should be. Research who the competition is and at what price they are selling gourmet cupcakes (this will provide a base for a target price). Provide the detailed information for at least 3 competitors. Based on the target price developed, a projection of selling 22,000 cupcakes with an expectation of a 15% profit, what is the maximum cost allowable for all expenses? (15 points). Develop a price using cost-based pricing assuming that Jay expects to sell 22,000 cupcakes a year and would like to have a 15% profit (15 points). If the selling price is $3.50 per cupcake, what is the contribution margin per cupcake and contribution margin ratio (10 points). At a selling price of $3.50 per cupcake, how many cupcakes need to be sold in order to break-even? What is the break-even in sales dollars? (15 points). Based on a selling price of $3.50 prepare a cost/volume/profit graph (Hint: this is explained in Module 16. Also, here is link to a video that explains how to create the graph on Excel: https://www.youtube.com/watch?v=aE0D5FUgxyM) (20 points). Prepare a cash budget for the company's first year of operations based on sales of 22,000 cupcakes at a price of $3.50 per cupcake. The budget should be prepared on a quarterly basis. Assume all sales are cash sales and that all costs and expenses are paid in cash. Rent, insurance, and advertising costs will be paid on a monthly basis. A minimum cash balance of $2,500 should be maintained (20 points). Prepare the company's forecasted income statement for the year ended on 12/31/2020 based on the sale of 22,000 cupcakes at $3.50 per cupcake (15 points). Prepare a forecasted balance sheet as of December 31, 2020 based on the sale of 22,000 cupcakes at $3.50 per cupcake (15 points). Prepare a forecasted statement of cash flows for the year ended December 31, 2020 based on the sale of 22,000 cupcakes at $3.50 per cupcake (15 points) Describe a minimum of three variances that Jay could analyze to monitor the business (minimum 200 words). (15 points) For future capital investment decisions, which capital budgeting model would you recommend to Jay? Why? (minimum 200 words) (15 points) What is your recommendation to Jay regarding this business venture? Provide an explanation incorporating the results of the calculations performed (200-300 words) (15 points). Jay's Cupcakes Income Statement For the period October 1, 2019 through December 31, 2019 Sales 17,500 Cost of Goods Sold 4,500 Gross Profit 13,000 Operating Expenses Salaries 7,360 Rent 2,400 Advertising 1,500 Utilities 450 Depreciation 275 Insurance 200 12,185 Net Income 815 Jay's Cupcakes Retained Earnings Statement For the period October 1, 2019 through December 31, 2019 - 1 Retained Earnings, beginning Net Income | $ $ 815 Retained Earnings, ending 815 Jay's Cupcakes Balance Sheet As of December 31, 2019 Assets Current Assets Cash 8,390 Total Current Assets 8,390 Property, Plant, and Equipment, net 7,425 Total Assets 15,815 Liabilities and Equity Common Stock 15,000 Retained Earnings 815 Total Liabilities and Equity 15,815 The purpose of this case study is to help you integrate the managerial accounting concepts that were covered in class and apply them to a real-world business setting. Business Description A friend, Jay Green, recently opened a cupcake store to sell gourmet cupcakes. Jay has asked you for help with formulating the projected numbers for the business and help analyze if the company will be successful. Using the skills you have developed in ACCT 551 Accounting for Managers, you will analyze the business to provide a forecast and recommendations for the business venture. Jay opened the business on October 1, 2019 and has provided the financial information for the period October 1, 2019 through December 31, 2019. Provide answers to the required items based on the information provided below and other amounts calculated: Cost information: Jay purchases his cupcakes from a baker for $10.80 per dozen cupcakes. Jay has a location near downtown that is rented for $800 per month. Utilities average $150 per month. Fixtures for the business were purchased for $7,700 (depreciation will be $1,100 per year for 7 years) Jay is open 7 days per week from 10:00 AM until 6:00 PM. The store is operated by one employee at a time. The employees are paid $10.00 per hour. Business insurance has been obtained at a cost of $800 per year. Jay has paid $1,500 for advertising during the first 3 months and plans on continuing with the current advertising. The financial statements prepared by Jay for the period October 1, 2019 through December 31, 2019 are attached. Requirements: Using separate tabs in a spreadsheet, provide your answers for the following. Develop the annual cost formula in Y = a + bX format, i.e. Total Costs = Fixed Costs + (Variable Cost per Unit times number of units) (15 points). Jay is currently selling the cupcakes for $3.50 each. Determine if Jay's selling price is appropriate by researching what the target price should be. Research who the competition is and at what price they are selling gourmet cupcakes (this will provide a base for a target price). Provide the detailed information for at least 3 competitors. Based on the target price developed, a projection of selling 22,000 cupcakes with an expectation of a 15% profit, what is the maximum cost allowable for all expenses? (15 points). Develop a price using cost-based pricing assuming that Jay expects to sell 22,000 cupcakes a year and would like to have a 15% profit (15 points). If the selling price is $3.50 per cupcake, what is the contribution margin per cupcake and contribution margin ratio (10 points). At a selling price of $3.50 per cupcake, how many cupcakes need to be sold in order to break-even? What is the break-even in sales dollars? (15 points). Based on a selling price of $3.50 prepare a cost/volume/profit graph (Hint: this is explained in Module 16. Also, here is link to a video that explains how to create the graph on Excel: https://www.youtube.com/watch?v=aE0D5FUgxyM) (20 points). Prepare a cash budget for the company's first year of operations based on sales of 22,000 cupcakes at a price of $3.50 per cupcake. The budget should be prepared on a quarterly basis. Assume all sales are cash sales and that all costs and expenses are paid in cash. Rent, insurance, and advertising costs will be paid on a monthly basis. A minimum cash balance of $2,500 should be maintained (20 points). Prepare the company's forecasted income statement for the year ended on 12/31/2020 based on the sale of 22,000 cupcakes at $3.50 per cupcake (15 points). Prepare a forecasted balance sheet as of December 31, 2020 based on the sale of 22,000 cupcakes at $3.50 per cupcake (15 points). Prepare a forecasted statement of cash flows for the year ended December 31, 2020 based on the sale of 22,000 cupcakes at $3.50 per cupcake (15 points) Describe a minimum of three variances that Jay could analyze to monitor the business (minimum 200 words). (15 points) For future capital investment decisions, which capital budgeting model would you recommend to Jay? Why? (minimum 200 words) (15 points) What is your recommendation to Jay regarding this business venture? Provide an explanation incorporating the results of the calculations performed (200-300 words) (15 points). Jay's Cupcakes Income Statement For the period October 1, 2019 through December 31, 2019 Sales 17,500 Cost of Goods Sold 4,500 Gross Profit 13,000 Operating Expenses Salaries 7,360 Rent 2,400 Advertising 1,500 Utilities 450 Depreciation 275 Insurance 200 12,185 Net Income 815 Jay's Cupcakes Retained Earnings Statement For the period October 1, 2019 through December 31, 2019 - 1 Retained Earnings, beginning Net Income | $ $ 815 Retained Earnings, ending 815 Jay's Cupcakes Balance Sheet As of December 31, 2019 Assets Current Assets Cash 8,390 Total Current Assets 8,390 Property, Plant, and Equipment, net 7,425 Total Assets 15,815 Liabilities and Equity Common Stock 15,000 Retained Earnings 815 Total Liabilities and Equity 15,815

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started