Gu and Lev (2011) argue that the root cause of many goodwill write-offs is that the shares

Question:

Gu and Lev (2011) argue that the root cause of many goodwill write-offs is that the shares of the buyer are overpriced at the acquisition date.

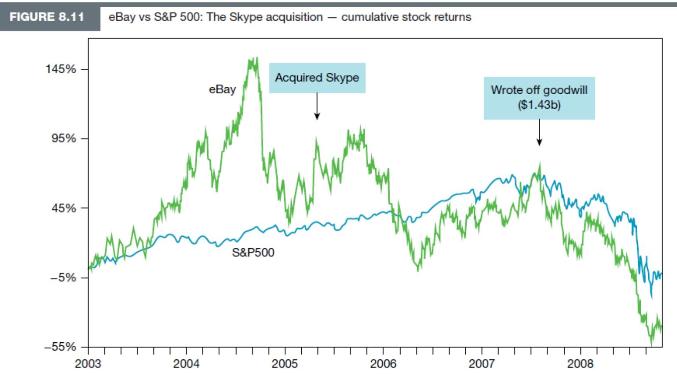

Figure 8.11 presents eBay's cumulative stock return against the S\&P 500 index from 2003. In mid-September 2005, eBay acquired the internet phone company Skype for \(\mathbf{\$ 2 . 6}\) billion. On 1 October 2007, it announced a massive goodwill write-off of \(\$ 1.43\) billion ( \(55 \%\) of the acquisition price) related to the Skype acquisition.

Gu and Lev argue that the root cause of this behaviour is the incentives of managers of overvalued firms to acquire businesses, whether to exploit the overpricing for shareholders' benefit or to justify and prolong the overpricing to maintain a facade of growth. Goodwill write-offs are accordingly an important business event signalling a flawed investment strategy.

Required

1. Explain the circumstances under which goodwill is recognised and how any subsequent write-off occurs.

2. Explain why a significant goodwill write-off may signal a 'flawed investment strategy'.

Step by Step Answer:

Financial Reporting

ISBN: 9780730396413

4th Edition

Authors: Janice Loftus, Ken Leo, Sorin Daniliuc, Belinda Luke, Hong Nee Ang, Mike Bradbury, Dean Hanlon, Noel Boys, Karyn Byrnes