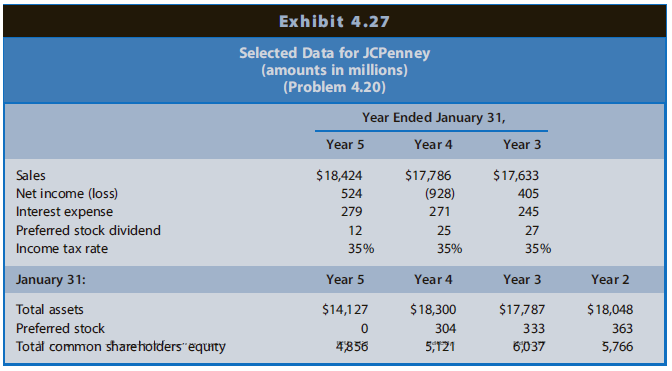

JCPenney operates a chain of retail department stores, selling apparel, shoes, jewelry, and home furnishings. It also

Question:

REQUIRED

a. Calculate the rate of ROA for fiscal Year 3, Year 4, and Year 5. Dis-aggregate ROA into the profit margin for ROA and total assets turnover components. The income tax rate is 35%.

b. Calculate the rate of ROCE for fiscal Year 3, Year 4, and Year 5. Disaggregate ROCE into the profit margin for ROCE, assets turnover, and capital structure leverage components.

c. Suggest reasons for the changes in ROCE over the three years.

d. Compute the ratio of ROCE to ROA for each year.

e. Calculate the amount of net income available to common stockholders derived from the use of financial leverage with respect to creditors' capital, the amount derived from the use of preferred shareholders' capital, and the amount derived from common shareholders' capital for each year.

f. Did financial leverage work to the advantage of the common shareholders in each of the three years?Explain.

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a...

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw