Massachusetts Stove Company manufactures wood-burning stoves for the heating of homes and businesses. The company has approached

Question:

The company's woodstoves have two distinguishing characteristics: (1) the metal frame of the stoves includes inlaid soapstone, which increases the intensity and duration of the heat provided by the stoves and enhances their appearance as an attractive piece of furniture, and (2) a catalytic combustor, which adds heating potential to the stoves and reduces air pollution.

The company manufactures wood-burning stoves in a single plant in Greenfield, Massachusetts. It purchases metal castings for the stoves from foundries in Germany and Belgium. The soapstone comes from a supplier in Canada. These purchases are denominated in U.S. dollars. The catalytic combustor is purchased from a supplier in the United States. The manufacturing process is essentially an assembly operation. The plant employs an average of eight workers. The two keys to quality control are structural airtightness and effective operation of the catalytic combustor.

The company rents approximately 60% of the 25,000-square-foot building it uses for manufacturing and administrative activities. This building also houses the company's factory showroom. The remaining 40% of the building is not currently rented.

The company's marketing of woodstoves follows three channels:

1. Wholesaling of stoves to retail hardware stores. This channel represents approximately 20% of the company€™s sales in units.

2. Retail direct marketing to individuals in all 50 states. This channel utilizes (a) national advertising in construction and design magazines and (b) the sending of brochures to potential customers identified from personal inquiries. This channel represents approximately 70% of the company€™s sales in units. The company is the only firm in the industry with a strategic emphasis on retail direct marketing.

3. Retailing from the company€™s showroom. This channel represents approximately 10% of the company€™s sales in units.

The company offers three payment options to retail purchasers of its stoves:

1. Full payment: Check, money order, or charge to a third-party credit card is used to pay in full.

2. Layaway plan: Monthly payments are made over a period not exceeding one year. The company ships the stove after receiving the final payment.

3. Installment financing plan: The company has a financing arrangement with a local bank to finance the purchase of stoves by credit-approved customers. The company is liable if customers fail to repay their installment bank loans.

The imposition of strict air emission standards by the Environmental Protection Agency (EPA) has resulted in a major change in the woodstove industry. By December 31, Year 9, firms were required by EPA regulations to demonstrate that their woodstoves met or surpassed specified air emission standards. These standards were stricter than industry practices accommodated at the time, and firms had to engage in numerous company-sponsored and independent testing of their stoves to satisfy EPA regulators. As a consequence, the number of firms in the woodstove industry decreased from more than 200 in the years prior to Year 10 to approximately 35 by December 31, Year 11.

The company received approval for its Soapstone Stove I in Year 11, after incurring retooling and testing costs of $63,001. It capitalized these costs in the Property, Plant, and Equipment account. It depreciates these costs over the five-year EPA approval period. A second stove, Soapstone Stove II, is currently undergoing retooling and testing. For this stove, the company incurred costs of $19,311 in Year 10 and $8,548 in Year 11 and has received preliminary EPA approval. It anticipates additional design, tooling, and testing costs of approximately $55,000 in Year 12 and $33,000 in Year 13 to obtain final EPA approval.

The company holds an option to purchase the building in which it is located for $608,400. The option also permits the company to assume the unpaid balance on a low-interest-rate loan on the building from the New England Regional Industrial Development Authority. The interest rate on this loan is adjusted annually and equals 80% of the bank prime interest rate. The unpaid balance on the loan exceeds the option price and will result in a cash transfer to the company from the owner of the building at the time of transfer. The company exercised its option in Year 9, but the owner of the building refused to comply with the option provisions. The company sued the owner. The case has gone through the lower court system in Massachusetts and is currently under review by the Massachusetts Supreme Court. The company incurred legal costs totaling $68,465 through Year 11 and anticipates additional costs of approximately $45,000 in Year 12. The lower courts have ruled in favor of the company's position on all of the major issues in the case. The company expects the Massachusetts Supreme Court to concur with the decisions of the lower courts when it renders its final decision in the spring of Year 12. The company has held discussions with two prospective tenants for the building's 10,000 square feet that Massachusetts Stove Company does not use in its operations.

Jane O'Neil owns 51% of the company's common stock. The remaining stockholders include John O'Neil (chief financial officer and father of Jane O'Neil), Mark Forest (vice president of manufacturing), and four independent local investors.

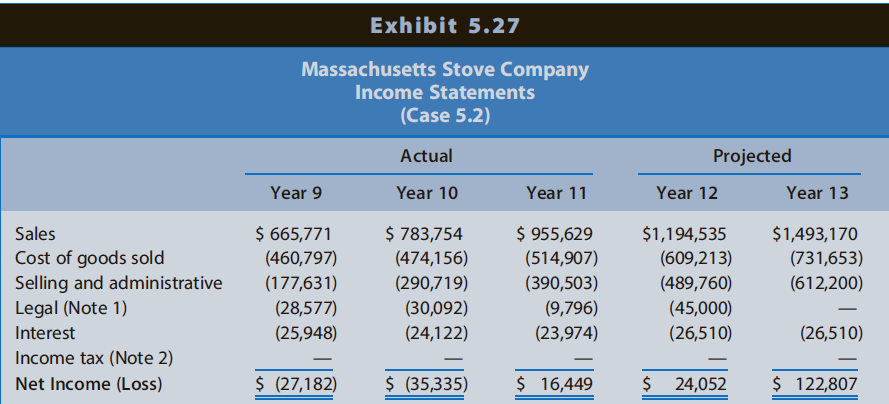

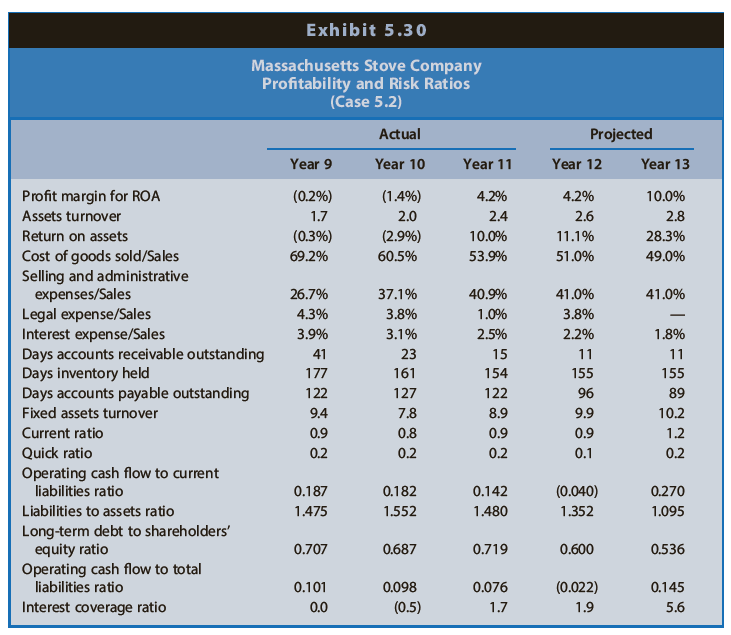

To assist in the loan decision, the company provides you with financial statements (see the first three columns of Exhibits 5.27-5.29) and notes for the three years ending December 31, Year 9, Year 10, and Year 11. These financial statements were prepared by John O'Neil, chief financial officer, and are not audited. The company also provides you with projected financial statements for Year 12 and Year 13 (see the last two columns of Exhibits 5.27-5.29) to demonstrate its need for the loan and its ability to repay. The loan requested involves an increase in the current loan amount from $93,091 to $143,091. The company will pay monthly interest and repay the $50,000 additional amount borrowed by December 31, Year 13. Exhibit 5.30 presents financial statement ratios for the company.

The assumptions underlying the projected financial statements are as follows:

- Sales: Sales are projected to increase 25% annually during the next two years, after increasing 17.7% in Year 10 and 21.9% in Year 11. The increase reflects continuing market opportunities related to the company€™s strategic emphasis on retail direct marketing and to the expected continuing contraction in the number of competitors in the industry.

- Cost of Goods Sold: Most manufacturing costs vary with sales. The company projects cost of goods sold to equal 51% of sales in Year 12 and 49% of sales in Year 13, having declined from 69.2% of sales in Year 9 to 53.9% of sales in Year 11. The reductions resulted from a higher proportion of retail sales in the sales mix (which have a higher gross margin than wholesale sales), a more favorable pricing environment in the industry (fewer competitors), a switch to lower-cost suppliers, and more efficient production.

- Selling and Administrative Expenses: The company projects these costs to equal 41% of sales, having increased from 26.7% of sales in Year 9 to 40.9% of sales in Year 11. The increases resulted from a heavier emphasis on retail sales, which require more aggressive marketing than wholesale sales.

- Legal Expenses: The additional $45,000 of legal costs represents the best estimate by the company€™s attorneys.

- Interest Expense: Interest expense has averaged approximately 6% of short- and long term borrowing during the last three years. The projected income statement assumes a continuation of the 6% average rate.

- Income Tax Expense: The company has elected to be taxed as a Sub chapter S corporation, which means that the net income of the firm is taxed at the level of the individual shareholders, not at the corporate level. Thus, the pro forma financial statements include no income tax expense. The firm operated at a net loss for several years prior to Year 11, primarily because of losses of a lawn products business that it acquired 10 years ago. The company discontinued the lawn products business in Year 10.

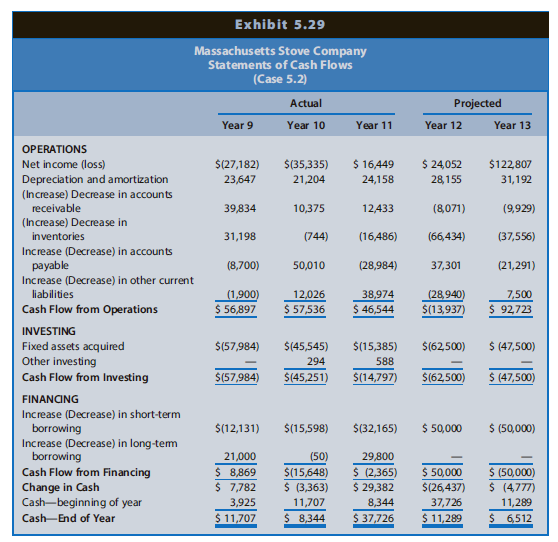

- Cash: The projected amounts for cash represent a plug to equate projected assets with projected liabilities and shareholders€™ equity. Projected liabilities include the requested loan during Year 12 and its repayment at the end of Year 13. Accounts Receivable: Days accounts receivable outstanding, calculated on the average accounts receivable balances, will be 11 days in Year 12 and Year 13.

- Inventories: Days inventory held, calculated on the average inventory balances, will be 155 days in Year 12 and Year 13.

- Property, Plant, and Equipment: Capital expenditures for Year 12 include a $55,000 cost for retooling the Soapstone Stove II and $7,500 for other equipment; for Year 13, they include $33,000 for retooling the Soapstone Stove II and $14,500 for other equipment. The projected balance excludes the cost of acquiring the building, its related debt, the cash received at the time of transfer, and rental revenues from leasing the unused 40% of the building to other businesses.

- Accumulated Depreciation: This is a continuation of the historical relation between depreciation expense and the cost of property, plant, and equipment. Other Assets: A new financial reporting standard no longer requires amortization of intangibles after Year 11.

- Accounts Payable: Days accounts payable outstanding, based on the average accounts payable balances, will be 97 days in Year 12 and 89 days in Year 13. The decrease in days payable reflects the ability to pay suppliers more quickly with the proceeds of the increased bank loan.

- Notes Payable: Notes payable is projected to increase by the amount of the bank loan in Year 12 and to decrease by the loan repayment at the end of Year 13.

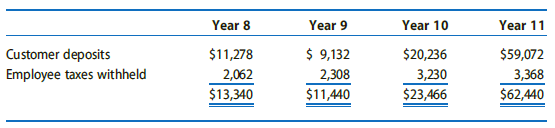

- Other Current Liabilities: The large increase at the end of Year 11 resulted from a major promotional offer in the fall of Year 11, which increased the amount of deposits by customers. The projected amounts for Year 12 and Year 13 represent more normal expected levels of deposits.

- Long-Term Debt: Long-term borrowing represents loans from shareholders to the company. The company does not plan to repay any of these loans in the near future.

- Retained Earnings: The change each year represents net income or net loss from operations. The company does not pay dividends.

- Statement of Cash Flows: Amounts are taken from the changes in various accounts on the actual and projected balance sheets.

Notes to Financial Statements

Note 1: The company has incurred legal costs to enforce its option to purchase the building used in its manufacturing and administrative activities. The case is under review by the Massachusetts Supreme Court, with a decision expected in the spring of Year 12.

Note 2: The company is not subject to income tax because it has elected Subchapter S tax status.

Note 3: The notes payable to banks are secured by machinery and equipment, shares of common stock of companies traded on the New York Stock Exchange owned by two shareholders, and personal guarantees of three shareholders. The long-term debt consists of unsecured loans from three shareholders.

Note 4: Other current liabilities include the following:

REQUIRED

Would you make the loan to the company in accordance with the stated terms? Explain. In responding, consider the reasonableness of the company€™s projections, positive and negative factors affecting the industry and the company, and the likely ability of the company to repay the loan.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Accounts Payable

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw