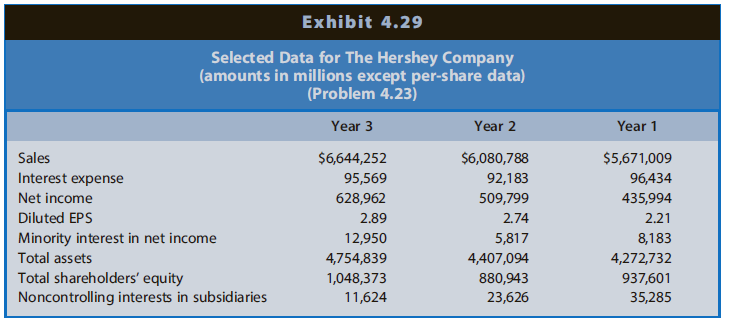

Selected data for The Hershey Company for Year 1 through Year 3 appear in Exhibit 4.29. REQUIRED

Question:

Selected data for The Hershey Company for Year 1 through Year 3 appear in Exhibit 4.29.

REQUIREDa. Compute ROA and its decomposition for Year 2 and Year 3. Assume a tax rate of 35%.b. Compute ROCE and its decomposition for Year 2 and Year 3.c. Interpret the trends in reported net income, EPS, ROA, and ROCE over the three-year period.

Transcribed Image Text:

Exhibit 4.29 Selected Data for The Hershey Company (amounts in millions except per-share data) (Problem 4.23) Year 3 Year 2 Year 1 Sales $6,644,252 $6,080,788 $5,671,009 Interest expense 95,569 92,183 96,434 Net income 628,962 509,799 435,994 Diluted EPS 2.89 2.74 2.21 Minority interest in net income 12,950 5,817 8,183 Total assets 4,754,839 4,407,094 4,272,732 Total shareholders' equity Noncontrolling interests in subsidiaries 937,601 35,285 1,048,373 880,943 11,624 23,626

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 88% (9 reviews)

a Profit Margin for ROA Year 3 660931 1 03595569 129506644252 111 Year 2 628962 1 03592183 581760807...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Question Posted:

Students also viewed these Business questions

-

Selected data for The Hershey Company for 2010-2012 appear in Exhibit 4.29. Required a. Compute ROA and its decomposition for 2010-2012. Assume a tax rate of 35%. b. Compute ROCE and its...

-

You are considering making a loan to The Hershey Company. The following information is from the financial statements included in Form 10-K for fiscal years 2012 and 2011 (in thousands of dollars):...

-

You are considering making a loan to The Hershey Company. The following information is from the financial statements included in Form 10-Kfbr fiscal years 2013 and 2012 (in thousands of dollars): Net...

-

The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and...

-

Ben is a 4% owner of a title company. In the following situations, is he a highly compensated employee? Why or why not? a. Ben receives a total salary of $110,000 and is a member of the top-paid...

-

Note: please show all relevant solution Question 1: Armidale Manufacturing Company's books show the following balances as of December 31, 2020. Materials inventory Work in process inventory Finished...

-

Describe the accounting for treasury stock.

-

The Shank Corporation issued $1,500,000 of 10% convertible bonds for $1,620,000 on March 1, 2006. The bonds are dated March 1, 2006, pay interest semiannually on August 31 and February 28, and the...

-

Income tax 2 Mohamed Khan and Aaron Grieve are equal partners in a small business which received the following income in 2020: business income of $150,000, interest of $4,000, and a capital gain of...

-

The total energy need during pregnancy is normally distributed, with mean = 2600 kcal/day and standard deviation = 50 kcal/day. Source: American Dietetic Association (a) Is total energy need during...

-

Selected financial data for Georgia-Pacific Corporation, a forest products and paper firm, appear in Exhibit 4.28. REQUIRED a. In which years did financial leverage work to the advantage of the...

-

FIGURE P18.61 shows two different processes by which 1.0 g of nitrogen gas moves from state 1 to state 2. The temperature of state 1 is 25?C. What are (a) Pressure p 1 (b) Temperatures (in ?C) T 2 ,...

-

What strategies produce the best co-authored documents?

-

The following information is available for two different types of businesses for the 2011 accounting period. Dixon Consulting is a service business that provides consulting services to small...

-

Marino Basket Company had a \(\$ 6,200\) beginning balance in its Merchandise Inventory account. The following information regarding Marino's purchases and sales of inventory during its 2011...

-

On March 6, 2011, Bob's Imports purchased merchandise from Watches Inc. with a list price of \(\$ 31,000\), terms \(2 / 10, n / 45\). On March 10, Bob's returned merchandise to Watches Inc. for...

-

The following events apply to Tops Gift Shop for 2012, its first year of operation: 1. Acquired \(\$ 45,000\) cash from the issue of common stock. 2. Issued common stock to Kayla Taylor, one of the...

-

Indicate whether each of the following costs is a product cost or a period (selling and administrative) cost. a. Transportation-in. b. Insurance on the office building. c. Office supplies. d. Costs...

-

Solve the given problems. As a ball bearing rolls along a straight track, it makes 11.0 revolutions while traveling a distance of 109 mm. Find its radius.

-

Suppose the spot and six-month forward rates on the Norwegian krone are Kr 5.78 and Kr 5.86, respectively. The annual risk-free rate in the United States is 3.8 percent, and the annual risk-free rate...

-

Problem 10.16 projected financial statements for Walmart for Years +1 through +5. The following data for Walmart include the actual amounts for 2012 and the projected amounts for Years + through +5...

-

a. Use the CAPM to compute the required rate of return on equity capital for Starbucks. b. Compute the weighted-average cost of capital for Starbucks as of the start of Year 1. At the start of Year...

-

May operates retail department store chains throughout the United States. Assume that at the end of Year 2, May's balance sheet reports debt of $4,658 million and common shareholders' equity at book...

-

Product Weight Sales Additional Processing Costs P 300,000 lbs. $ 245,000 $ 200,000 Q 100,000 lbs. 30,000 -0- R 100,000 lbs. 175,000 100,000 If joint costs are allocated based on relative weight of...

-

The projected benefit obligation was $380 million at the beginning of the year. Service cost for the year was $21 million. At the end of the year, pension benefits paid by the trustee were $17...

-

CVP Modeling project The purpose of this project is to give you experience creating a multiproduct profitability analysis that can be used to determine the effects of changing business conditions on...

Study smarter with the SolutionInn App