Data for The Athletic Attic are provided in P124B. Earnings per share for the year ended December

Question:

Data for The Athletic Attic are provided in P12–4B. Earnings per share for the year ended December 31, 2021, are $1.36. The closing stock price on December 31, 2021, is $22.42.

Required:

Calculate the following profitability ratios for 2021:

1. Gross profit ratio.

2. Return on assets.

3. Profit margin.

4. Asset turnover.

5. Return on equity.

6. Price-earnings ratio.

P12–4B

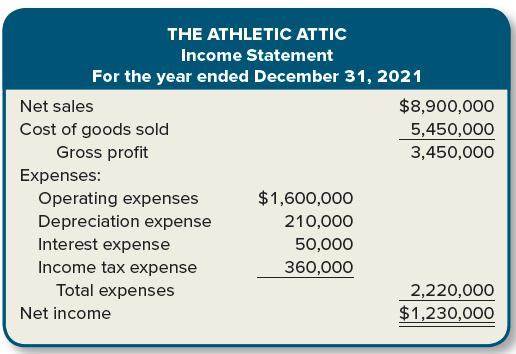

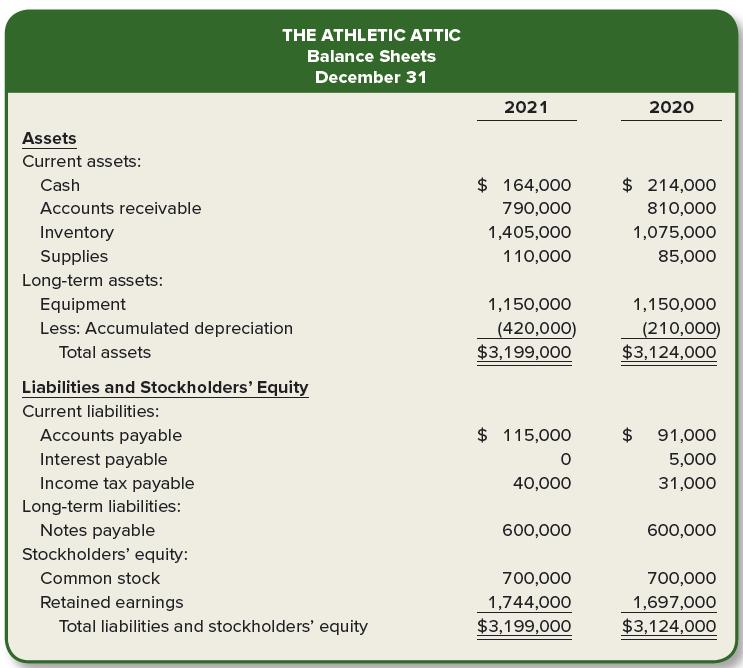

The following income statement and balance sheets for The Athletic Attic are provided.

THE ATHLETIC ATTIC Income Statement For the year ended December 31, 2021 Net sales $8,900,000 Cost of goods sold 5,450,000 Gross profit 3,450,000 Expenses: Operating expenses $1,600,000 Depreciation expense 210,000 Interest expense 50,000 Income tax expense 360,000 Total expenses 2,220,000 $1,230,000 Net income

Step by Step Answer:

CALCULATION OF RATIO FOR YEAR 2021 1 Gross profit ratio gross profit sales 100 3450...View the full answer

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Data for The Athletic Attic are provided in P12-4B. Earnings per share for the year ended December 31, 2012, are $1.26. The closing stock price on December 31, 2012, is $21.42. In P12-4B Required:...

-

Income statement and balance sheet data for The Athletic Attic are provided below. Required: 1. Calculate the following risk ratios for 2012 and 2013: a. Receivables turnover ratio. b. Inventory...

-

Income statement and balance sheet data for The Athletic Attic are provided below. Required: 1. Calculate the following risk ratios for 2015 and 2016: a. Receivables turnover ratio. b. Inventory...

-

Secondary xylem and phloem in dicot stem are produced by (a) Phellogen (b) Apical meristems (c) Axillary meristems (d) Vascular cambium

-

Match each enzyme name in the left column with the correct descriptive phrase in the right column. a. Topoisomerase II .................... i. Catalyzes most nucleotide...

-

Cleveland Inc. leased a new crane to Abriendo Construction under a 5-year noncancelable contract starting January 1, 2014. Terms of the lease require payments of $33,000 each January 1, starting...

-

(p. 139). Consider a random sample of 10 doctors, each of whom is confronted with an ethical dilemma (e.g., an end-of-life issue or treatment of a patient without insurance). What is the probability...

-

The 2014 data that follow pertain to Ricks Radical Eyewear, a manufacturer of swimming goggles. (Ricks Radical Eyewear had no beginning Finished Goods Inventory in January 2014.) Number of goggles...

-

Dorinda,Luis and Elizabeth are partners in a limited partnership. Dorinda and Luis, the limited partners, each own 35 percent of the partnership and Elizabeth, the general partner, owns the other 30...

-

Hanks Company is developing its annual financial statements at December 31, current year. The statements are complete except for the statement of cash flows. The completed comparative balance sheets...

-

The following income statement and balance sheets for The Athletic Attic are provided. Required: Assuming that all sales were on account, calculate the following risk ratios for 2021: 1. Receivables...

-

Income statement and balance sheet data for The Athletic Attic are provided below. Required: 1. Calculate the following risk ratios for 2021 and 2022: a. Receivables turnover ratio. b. Inventory...

-

If $10,000 is invested at 7% compounded continuously, what is the value of the investment after 20 years?

-

The Reciprocal Method Solve the Simultaneous Equations: S1=170,000+(0.2*S2) S2=68,000+(0.2*S1) S1=170,000+[0.2*(68,000+0.2*S1)]

-

Solve X+1U6x-13x+2-4x+5

-

Summarize the selected poster's design format, such as the color, layout, font style, size, space, and the subject's analysis format. Also, analyze how the study started. Such as background and...

-

Income statement Prior year Current year Revenues 782.6 900.0 Cost of sales Selling costs Depreciation (27.0) (31.3) Operating profit 90.4 85.7 Interest Earnings before taxes 85.4 78.2 Taxes (31.1)...

-

View the video at the slide title "Lab: Social Media Post" at time 28:20. Link:...

-

Write a program that reads a line of text and then displays the line, but with the first occurrence of hate changed to love. For example, a possible sample dialogue might be Enter a line of text. I...

-

Draw two scatterplots, one for which r = 1 and a second for which r = 21.

-

What happens to the special journal in a computerized accounting system that uses electronic forms?

-

How would e-commerce improve the revenue/collection cycle?

-

How would e-commerce improve the revenue/collection cycle?

-

Required information Required information Problem 7 - 7 ( Static ) Calculate depreciation of property and equipment and amortization of intangible assets ( LO 7 - 4 , 7 - 5 ) [ The following...

-

Process Costing - Weighted Average Method Work In Process 1 0 / 1 - 1 6 , 0 0 0 units Direct Material: 1 0 0 % complete $ 5 4 , 5 6 0 Conversion Cost: 1 0 % complete $ 3 5 , 5 6 0 Balance WIP 1 0 / 1...

-

A merchandising concern paid $1,600,000 for inventory. The market value of the inventory is $1,200,000. The net realizable value of the inventory is $1,300,000. The company found a new supplier for...

Study smarter with the SolutionInn App