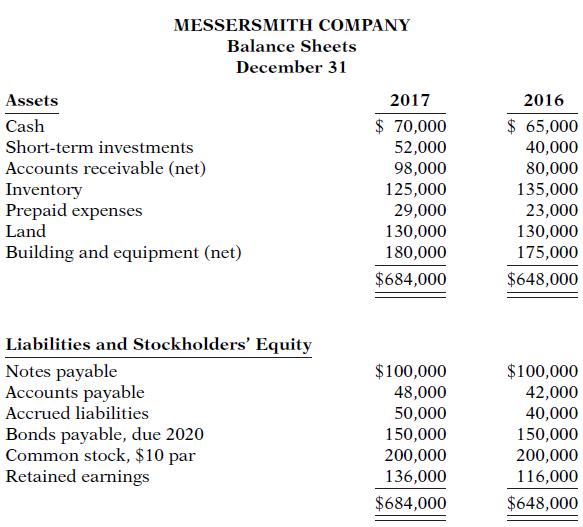

Financial information for Messersmith Company is presented below. Additional information: 1. Inventory at the beginning of 2016

Question:

Financial information for Messersmith Company is presented below.

Additional information:

1. Inventory at the beginning of 2016 was $118,000.

2. Total assets at the beginning of 2016 were $630,000.

3. No common stock transactions occurred during 2016 or 2017.

4. All sales were on account. Accounts receivable, net at the beginning of 2016, were $88,000.

5. Notes payable are classified as current liabilities.

Instructions

(a) Indicate, by using ratios, the change in liquidity and profitability of Messersmith Company from 2016 to 2017. (Note: Not all profitability ratios can be computed.)

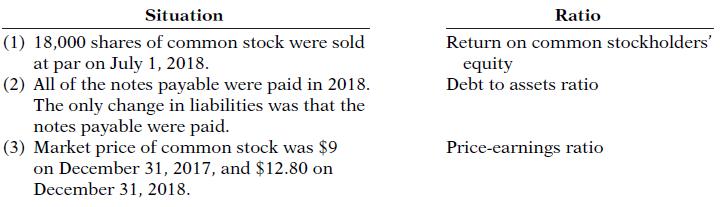

(b) Given below are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as of December 31, 2017, and (2) as of December 31, 2018, after giving effect to the situation. Net income for 2018 was $50,000. Total assets on December 31, 2018, were $700,000.

Step by Step Answer:

Accounting Principles

ISBN: 978-1118875056

12th edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso