Dry Quick (DQ) is a medium-sized, private manufacturing company located near Timmins, Ontario. DQ has a June

Question:

Dry Quick (DQ) is a medium-sized, private manufacturing company located near Timmins, Ontario. DQ has a June 30 year-end. Your firm, Poivre & Sel (P&S), has recently been appointed as auditors forDQ.

It is now August 2, Year 10. You, CPA, have been asked to take on the senior role on the audit. The following information has been provided to help you familiarize yourself with the client: information on DQ (Exhibit III), a draft income statement prepared by management in accordance with ASPE (Exhibit IV), notes from your firm's meetings with management and the Board Chair (Exhibit V), and excerpts from the current-year audit file (Exhibit VI).

The following week, the audit partner on the file calls you into his office and says, "Now that you've had the file for a week, can you let me know what accounting issues you've identified and your recommendations for resolution of these issues."

Exhibit III:

Information on Dry Quick:

DQ manufactures portable heating and drying units. The units include heat exchangers that heat and circulate dry air, making them useful on construction sites. The technology was invented by Yuda Mann, the current Chief Executive Officer (CEO) . DQ holds a number of patents and is protective of its proprietary technology. Seed capital was provided from the sale of shares to Yuda's friends, family members, and employees, as well as through bank financing.

As the company grew, Yuda recognized the need for a CFO, particularly since he is more involved with research and development and manufacturing operations. Since it was difficult to recruit someone to come to Timmins, Yuda decided to recruit someone with the right skill set, regard less of location. Two years ago, DQ hired Randy Wall , a CPA located in Toronto. Randy works out of Toronto and spends about one week per month in Timmins. The bookkeeper, Melanie Beech, works in Timmins but reports to Randy. Despite the fact that Randy was hired as the CFO, he really enjoys sales and marketing. Randy has been instrumental in DQ's rapid sales growth because he is willing to travel extensively throughout North America to meet potential customers. With Randy involved in sales, Yuda says he thinks of himself as more of a Chief Operating Officer (COO) than a CEO. Yuda says that he completely trusts Randy, and defers most decisions other than those related to manufacturing to him.

A venture capital firm, VC Ventures (VC), obtained a 20% interest in DQ about three years ago. Yuda owns 40% of the outstanding common shares of the company, while Randy holds 15%. The remaining shares are held by Yuda's friends, family members, and DQ employees. Two directors of VC sit on DQ's Board, along with Yuda, Randy, and one other member of DQ's management.

VC and DQ's management have been actively pursuing a buyer for the company . In the past year, DQ engaged in negotiations with one company; however, the deal was not completed and is no longer being pursued. A second potential buyer has now been identified and has started some preliminary due diligence.

The current year's earnings are expected to be a key part of the determination of the purchase price.

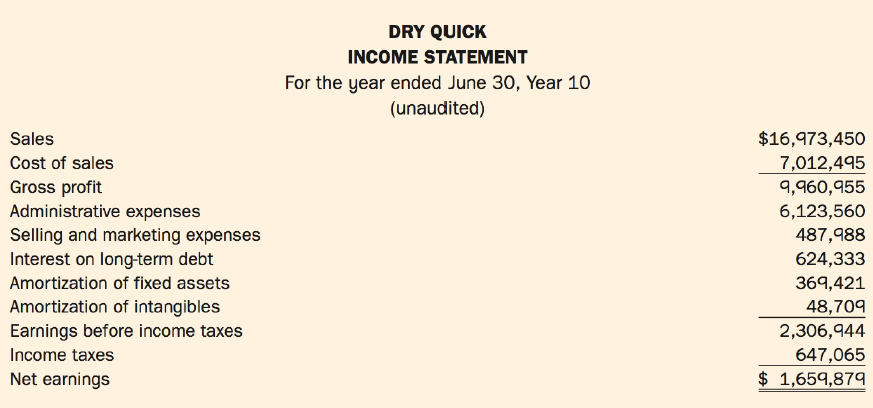

Exhibit IV:

Draft Income Statement Prepared by Management:

Exhibit V:

Notes from Meetings with Management and Board Chair:

Bookkeeper: Melanie Beech-Melanie has been cooperative. She provided us with a schedule supporting the sales commission expense accrual of $150,000 prior to Randy's review, which showed a commission rate of 5%. This was higher than the rate accrued in the general ledger of 3%, which was supported by a schedule prepared by Randy . Melanie didn't know which percentage was correct, because she can't seem to

find a written agreement with the salespeople.

Board Chair: Nathan Cole of VC-The Board has not met regularly as a group for most of the past year because Randy has been unavailable. Nathan has also not received the monthly reports promised to him by management. Nathan finds Randy difficult to contact and has given up trying to obtain information from him.

CEO: Yuda Mann-Yuda is proud of the products DQ produces and the business he has built up; however, he prefers dealing with product development and is grateful that, except for manufacturing, Randy has taken over almost everything, including sales. Not only is DQ sel ling more products, but its gross margin which was around 50% has increased. With these results, Yuda is happy to continue to focus on the products and

to let Randy deal with everything else.

CFO: Randy Wall-Randy has indicated that he has achieved increased sales due in part to the new Early Order Program, which provides a 15% discount to buyers committing to purchases in advance. Any purchase orders that were placed by June 15 and accompanied by a 10% deposit were eligible for the program, with delivery of the units to occur within four months. The program was highly successful, resulting in total sales of $1.5 mill ion being recognized related to these bill and hold arrangements. In addition, DQ sends demonstration units to customers (demos) which they have the option to return with in six months if they are not satisfied with performance. Demos with a total sales value of $400,000 were delivered to customers fairly evenly throughout the year. Based on his estimate of returns over the past two years, Randy has recognized 80% of the items as sales.

Exhibit VI:

Excerpts from the Current-Year Audit File

Preliminary audit work included the following:

Accounts receivable confirmations-Sample size was calculated based on a preliminary materiality of $80,000, which represents 5% of net earnings. A number of confirmations received were initially returned with discrepancies. One customer indicated that a total of four of the units confirmed, worth approximately $25,000 each, were demos and would be returned. For other outstanding confirmations, Randy followed up with those customers, and the confirmations were received by him shortly thereafter. He also dealt with confirmation discrepancies related to the Early Order Program, as customers seemed unsure whether or not to include these purchases in the amounts confirmed. Accounts receivable includes approximately $1,350,000 related to the Early Order Program.

Inventory count-A junior audit team member attended the inventory count in Timmins on June 30, Year 10. A few discrepancies were noted. In some instances, the junior noted that there were more items on the floor than were reported on the inventory listing. This finding may be due to the Early Order Program because those units remain on site with the rest of the inventory. During the count, the staff noted some returned demos that were included as part of the new inventory. Randy recorded the returned units at the same value as new units.

Inventory overhead testing-We still need to test the overhead allocated to inventory. Per Randy, other than some of the specific percentages noted below, he generally allocates 60% of administrative costs to inventory because most of DQ's operations are ultimately about production. Some items in overhead include:

- 100% of the depreciation re lated to manufacturing

- 60% of the depreciation related to the head office building

- 60% of the advertising costs

- Partial allocation of several employees' salaries, including 75% of each of the following salaries: CEO,

- CFO, and administrative staff

Merger & acquisition costs-DQ has capitalized $350,000 of costs related to legal and other expenses for the first offer to purchase. While the first offer is no longer active, much of the work done on the first offer can be leveraged for future offers. Most of the costs incurred related to preparing the company for purchase, thus greatly improving its marketability.

Subsequent disbursements-The disbursements subsequent to year-end that were selected for testing include commissions to a salesperson of approximately $37,500 (related to $750,000 in sales during the last quarter of the Year 10 fiscal year) and $26,420 for one of Randy's expense reports. The expense report had not been approved by anyone other than Randy . It appeared to be for expenses incurred subsequent to year-end, and therefore was appropriately not accrued.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell