The 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,250,000,

Question:

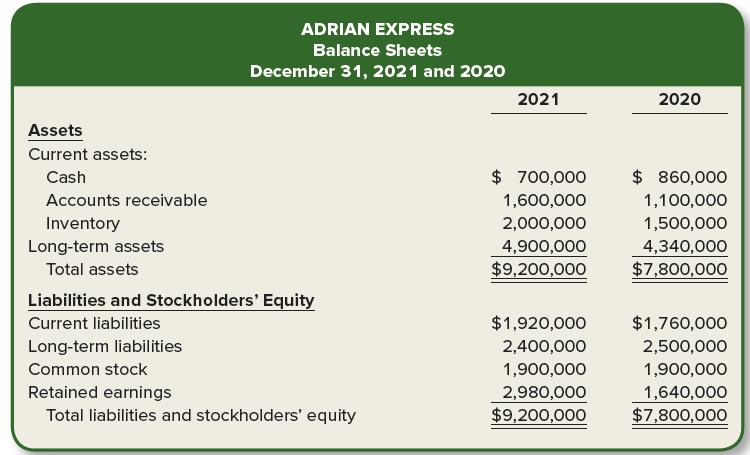

The 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,250,000, and net income of $1,700,000. Balance sheet information is provided in the following table.

Industry averages for the following four risk ratios are as follows:

Average collection period ................ 25 days

Average days in inventory ............... 60 days

Current ratio ........................................... 2 to 1

Debt to equity ratio ............................ 50%

Required:

1. Calculate the four risk ratios listed above for Adrian Express in 2021.

2. Do you think the company is more risky or less risky than the industry average? Explain your answer.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann