A fixed-income analyst is asked to rank three bonds in terms of interest rate risk. Interest rate

Question:

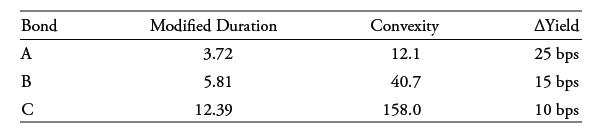

A fixed-income analyst is asked to rank three bonds in terms of interest rate risk. Interest rate risk here means the potential price decrease on a percentage basis given a sudden change in financial market conditions. The increases in the yields-to-maturity represent the “worst case” for the scenario being considered.

The modified duration and convexity statistics are annualized. ΔYield is the increase in the annual yield-to-maturity. Rank the bonds in terms of interest rate risk.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: