A Japanese corporation recently sold one of its lines of business and would like to use the

Question:

A Japanese corporation recently sold one of its lines of business and would like to use the cash to retire the debt liabilities that financed those assets. Summary statistics for the multiple debt liabilities, which range in maturity from three to seven years, are market value, JPY 110.4 billion; portfolio modified duration, 5.84; portfolio convexity, 46.08; and BPV, JPY 64.47 million.

An investment bank working with the corporation offers three alternatives to accomplish the objective:

1. Bond tender offer. The corporation would buy back the debt liabilities on the open market, paying a premium above the market price. The corporation currently has a single-A rating and hopes for an upgrade once its balance sheet is improved by retiring the debt. The investment bank anticipates that the tender offer would have to be at a price commensurate with a triple-A rating to entice the bondholders to sell. The bonds are widely held by domestic and international institutional investors.

2. Cash flow matching. The corporation buys a portfolio of government bonds that matches, as closely as possible, the coupon interest and principal redemptions on the debt liabilities. The investment bank is highly confident that the corporation’s external auditors will agree to accounting defeasement because the purchased bonds are government securities. That agreement will allow the corporation to remove both the defeasing asset portfolio and the liabilities from the balance sheet.

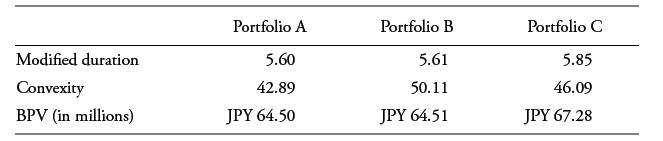

3. Duration matching. The corporation buys a portfolio of high-quality corporate bonds that matches the duration of the debt liabilities. Interest rate derivatives contracts will be used to keep the duration on its target as time passes and yields change. The investment bank thinks it is very unlikely that the external auditors will allow this strategy to qualify for accounting defeasement. The corporation can explain to investors and the rating agencies in the management section of its annual report, however, that it is aiming to “effectively defease” the debt. To carry out this strategy, the investment bank suggests three different portfolios of investment-grade corporate bonds that range in maturity from 2 years to 10 years. Each portfolio has a market value of about JPY 115 billion, which is considered sufficient to pay off the liabilities.

After some deliberation and discussion with the investment bankers and external auditors, the corporation’s CFO chooses Strategy 3, duration matching.

Indicate the likely trade-offs that led the corporate CFO to choose the duration matching strategy over the tender offer and cash flow matching.

Step by Step Answer: