An active United Statesbased credit manager faces the following US and European investment-grade and high-yield corporate bond

Question:

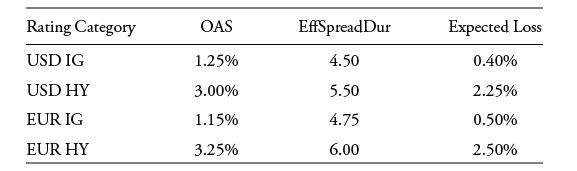

An active United States–based credit manager faces the following US and European investment-grade and high-yield corporate bond portfolio choices:

The EUR IG and EUR HY allocations are denominated in euros, and the euro is expected to depreciate by 2% versus the US dollar over the next year.

Which of the following active portfolios is expected to have the highest excess return versus the index if European economies are expected to experience an earlier and much stronger credit cycle recovery than the United States?

A. EUR HY 50.0%, EUR IG 25.0%, USD IG 12.5%, USD HY 12.5%

B. EUR IG 50.0%, EUR HY 25.0%, USD IG 12.5%, USD HY 12.5%

C. EUR HY 33.3%, US HY 33.3%, EUR IG 16.7%, USD IG 16.7%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: