Assume a hypothetical 30-year bond is issued on 15 August 2019 at a price of 98.195 (as

Question:

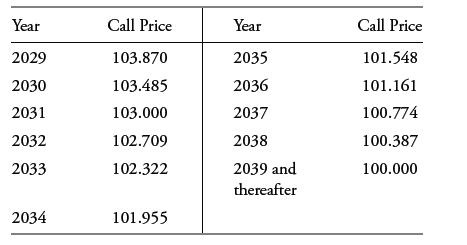

Assume a hypothetical 30-year bond is issued on 15 August 2019 at a price of 98.195 (as a percentage of par). Each bond has a par value of $1,000. The bond is callable in whole or in part every 15 August from 2029 at the option of the issuer. The call prices are shown below.

The call protection period is:

A. 10 years.

B. 11 years.

C. 20 years.

Transcribed Image Text:

Year 2029 2030 2031 2032 2033 2034 Call Price 103.870 103.485 103.000 102.709 102.322 101.955 Year 2035 2036 2037 2038 2039 and thereafter Call Price 101.548 101.161 100.774 100.387 100.000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (2 reviews)

A is correct The bonds w...View the full answer

Answered By

Issa Shikuku

I have vast experience of four years in academic and content writing with quality understanding of APA, MLA, Harvard and Chicago formats. I am a dedicated tutor willing to hep prepare outlines, drafts or find sources in every way possible. I strive to make sure my clients follow assignment instructions and meet the rubric criteria by undertaking extensive research to develop perfect drafts and outlines. I do this by ensuring that i am always punctual and deliver quality work.

5.00+

6+ Reviews

13+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider the following data collected from three independent populations. These data can also be found in the Excel file Prob 1828.xlsx. Perform a hypothesis test using α = 0.05 to...

-

In what manner can Walmart be elucidated, incorporating an analysis of its operational intricacies, firm-specific vulnerabilities, and distinctive attributes setting it apart from its industry...

-

Assume a hypothetical 30-year bond is issued on 15 August 2019 at a price of 98.195 (as a percentage of par). Each bond has a par value of $1,000. The bond is callable in whole or in part every 15...

-

Figure shows three rotating, uniform disks that are coupled by belts. One belt runs around the rims of disks A and C. Another belt runs around a central hub on disk A and the rim of disk B. The belts...

-

You are the auditor of Piedmore Corporation. You determine that the accounts receivable turnover has been much slower this period than in prior periods and that it is also materially lower than the...

-

Belda Co. makes organic juice in two departments: cutting and blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The...

-

A30-year fixed-rate mortgage has monthly payments of $1,500 per month and a mortgage interest rate of 9 percent per year compounded monthly. If a buyer purchases a home with the cash proceeds of the...

-

A household appliance dealer buys microwave ovens from a manufacturer and resells them to its customers. a. The manufacturer sets a list or catalogue price of $1,500 for a microwave. The manufacturer...

-

Depreciation as a Tax Shield The term tax shield refers to the amount of income tax saved by deducting depreciation for income tax purposes. Assume that Supreme Company is considering the purchase of...

-

Floating-rate notes most likely pay: A. Annual coupons. B. Quarterly coupons. C. Semi-annual coupons.

-

Which of the following is not an example of an embedded option? A. Warrant B. Call provision C. Conversion provision

-

What advantages do matrix structures have compared to functional structures?

-

Yellow M&Ms Express the confidence interval (0.0847, 0.153) in the form of P - E < p < p + E. 12. Blue M&Ms Express the confidence interval 0.255 (+-) 0.046 in the form of P - E < p < p + E.

-

An ideal, noble gas with a mass of 97.2 g at 25 C and a pressure of 608 torr has a volume of 22.7 L. 1. What is the pressure (in atm)? SHOW ALL WORK. 2. What is R (number and units)? 3. What is the...

-

A drug is used to help prevent blood clots in certain patients. In clinical trials, among 4705 patients treated with the drug, 170 developed the adverse reaction of nausea. Construct a 95% confidence...

-

the assessment include developing gantt chart, work breakdown structure and and all task 3 are related to its respective task 2. all the instructions are given in the assignment itself. Assessment...

-

Mens heights are normally distributed with mean 68.6in. and standard deviation 2.8in. Air Force Pilots The U.S. Air Force required that pilots have heights between 64 in. and 77 in. Find the...

-

A source and receiver of EM waves move relative to one another at velocity v. Let v be positive if the receiver and source are moving apart from one another. The source emits an EM wave at frequency...

-

A copper rod of length L =18.0 in is to be twisted by torques T (see figure) until the angle of rotation between the ends of the rod is 3.08. (a) If the allowable shear strain in the copper is 0.0006...

-

One organization that all students will have some knowledge about is their own college or university. What are the strengths, weaknesses, opportunities, and threats that you see facing your college...

-

Suppose a nonprofit organization's strategy requires that it phase out a program on which few people rely, but those people are vulnerable and no good substitute exists. How might the organization...

-

Select an organization that you know wellmaybe you work there, have been a volunteer, or just follow it on Twitter. What do you think is the organizations strategy, as that term is discussed in this...

-

18 Proprietary Ratio liquidity Accepted limits is 0.75:1 Total Shareholders Measures Funds conservatism of capital structure and Total Tangible Assets shows the extent of shareholders' funds in the...

-

On January 1, 2020, Blossom Wholesalers had Accounts Receivable 140,700, Notes Receivable 33,600, and Allowance for Doubtful Accounts 22,900. The note receivable is from Bramble Company. It is a...

-

In 2014, Citigroup experienced invoice fraud and reduced its net income from $13.9 billion to $13.7 billion. Multiple companies were involved in the accounts payable process, and Citigroup did not...

Study smarter with the SolutionInn App