Based on Exhibit 1, the probability of Orion defaulting on the bond during the first three years

Question:

Based on Exhibit 1, the probability of Orion defaulting on the bond during the first three years is closest to:

A. 1.07%.

B. 2.50%.

C. 3.85%.

John Smith, a fixed-income portfolio manager at a €10 billion sovereign wealth fund (the Fund), meets with Sofia Chan, a derivatives strategist with Shire Gate Securities (SGS), to discuss investment opportunities for the Fund. Chan notes that SGS adheres to ISDA (International Swaps and Derivatives Association) protocols for credit default swap (CDS) transactions and that any contract must conform to ISDA specifications. Before the Fund can engage in trading CDS products with SGS, the Fund must satisfy compliance requirements.

Smith explains to Chan that fixed-income derivatives strategies are being contemplated for both hedging and trading purposes. Given the size and diversified nature of the Fund, Smith asks Chan to recommend a type of CDS that would allow the Fund to simultaneously fully hedge multiple fixed-income exposures.

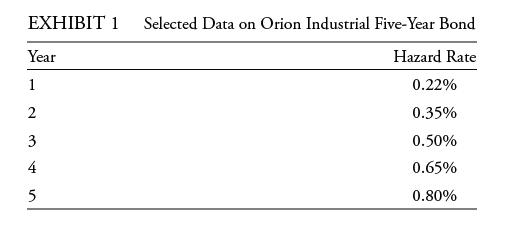

Smith and Chan discuss opportunities to add trading profits to the Fund. Smith asks Chan to determine the probability of default associated with a five-year investment-grade bond issued by Orion Industrial. Selected data on the Orion Industrial bond are presented in Exhibit 1.

Chan explains that a single-name CDS can also be used to add profit to the Fund over time. Chan describes a hypothetical trade in which the Fund sells £6 million of five-year CDS protection on Orion, where the CDS contract has a duration of 3.9 years. Chan assumes that the Fund closes the position six months later, after Orion’s credit spread narrowed from 150 bps to 100 bps.

Chan discusses the mechanics of a long/short trade. In order to structure a number of potential trades, Chan and Smith exchange their respective views on individual companies and global economies. Chan and Smith agree on the following outlooks.

Outlook 1: The European economy will weaken.

Outlook 2: The US economy will strengthen relative to that of Canada.

Outlook 3: The credit quality of electric car manufacturers will improve relative to that of traditional car manufacturers.

Chan believes US macroeconomic data are improving and that the general economy will strengthen in the short term. Chan suggests that a curve trade could be used by the Fund to capitalize on her short-term view of a steepening of the US credit curve.

Another short-term trading opportunity that Smith and Chan discuss involves the merger and acquisition market. SGS believes that Delta Corporation may make an unsolicited bid at a premium to the market price for all of the publicly traded shares of Zega, Inc. Zega’s market capitalization and capital structure are comparable to Delta’s; both firms are highly levered. It is anticipated that Delta will issue new equity along with 5- and 10-year senior unsecured debt to fund the acquisition, which will significantly increase its debt ratio.

Step by Step Answer: