Chaopraya is an investment advisor for high-net-worth individuals. One of her clients, Schuylkill, plans to fund her

Question:

Chaopraya is an investment advisor for high-net-worth individuals. One of her clients, Schuylkill, plans to fund her grandson’s college education and considers two options:

• Option 1: Contribute a lump sum of $300,000 in 10 years.

• Option 2: Contribute four level annual payments of $76,500 starting in 10 years.

The grandson will start college in 10 years. Schuylkill seeks to immunize the contribution today.

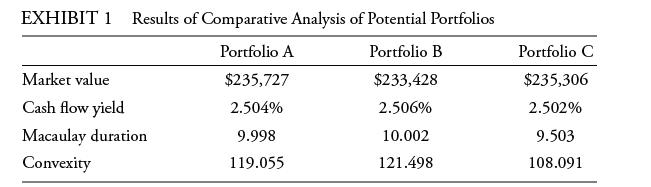

For Option 1, Chaopraya calculates the present value of the $300,000 as $234,535. To immunize the future single outflow, Chaopraya considers three bond portfolios given that no zero-coupon government bonds are available. The three portfolios consist of non-callable, fixed-rate, coupon-bearing government bonds considered free of default risk. Chaopraya prepares a comparative analysis of the three portfolios, presented in Exhibit 1.

Chaopraya evaluates the three bond portfolios and selects one to recommend to Schuylkill.

Discuss the effectiveness of Chaopraya’s immunization strategy in terms of duration gaps.

Step by Step Answer: