Consider the information from the bank and government annual coupon bonds from the prior example: Assuming that

Question:

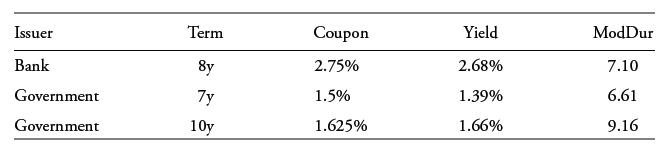

Consider the information from the bank and government annual coupon bonds from the prior example:

Assuming that 7- and 10-year swap spreads over the respective government benchmark yields to maturity are 15 bps and 20 bps, calculate the ASW and the I-spread for the bank bond, and interpret the difference between the two.

Transcribed Image Text:

Issuer Bank Government Government Term 8y 7y 10y Coupon 2.75% 1.5% 1.625% Yield 2.68% 1.39% 1.66% ModDur 7.10 6.61 9.16

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

1 Solve for the weights of the 7year and the 10year bond in the interpolation calculation ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

1) The mast on the boat is held in place by the rigging, which consists of rope having a diameter of 25 mm and a total length of 50m. Assuming the rope to be cylindrical, determine the drag it exerts...

-

Assume that Nike decides to build a shoe factory in Brazil; half the initial outlay will be funded by the parents equity and half by borrowing funds in Brazil. Assume that Nike wants to assess the...

-

For the test described in Exercise 10.32, assume that the true population mean for the new booklet is = 2.80 hours. Under this assumption, what is the probability that the false null hypothesis, H0:...

-

NONCONSTANT GROWTH VALUATION Hart Enterprises recently paid a dividend, D0, of $1 25. It expects to have nonconstant growth of 20% for 2 years followed by a constant rate of 5% thereafter. The firms...

-

The following information is from the 2007 annual reports of The Coca-Cola Company and of PepsiCo (all amounts are in millions of U.S. dollars). The information for PepsiCo is separated into overall...

-

undefined Walsh Company manufactures and sells one product. The following information pertains to each of the company's first two years of operations: Variable costs per unit: Manufacturing: Direct...

-

An active United Statesbased credit manager is offered similar US corporate bond portfolio choices to those in an earlier example: As in the earlier case, the manager expects an economic rebound but...

-

An active credit portfolio manager considers the following corporate bond portfolio choices familiar from an earlier example: The investor anticipates an economic slowdown in the next year that will...

-

Write a three page paper in which you: 1. Evaluate the importance of innovation for the long term survival for your chosen company as well as the industry that your chosen company fits in. Next,...

-

On January 1, 20X1, Elberta Company issued $50,000 of 4% convertible bonds, in total, into 5,000 shares of Elberta's common stock. No bonds were converted during 20X1. Throughout 20X1 Elberta had...

-

At Vision Club Company, office workers are employed for a 40-hour workweek and are quoted either a monthly or an annual salary (as indicated). Given on the form below are the current annual and...

-

8 Project two 15 UTSA Project two M Question 1 - Project two ChatGPT C chegg.com/homework-he X Course Hero how to take a sxreen shot X +...

-

Charitable purposes: Section 3(1) Charities Act 2011 1. Prevention or relief of poverty 2. Education 3. Religion, now includes: 4. - - A religion which involves belief in more than one god A religion...

-

Jack Price, The finance director of Humpty Doo Investment Ltd ( HDIL ) , is unsure whether he should consolidate some of the investments that the company owns. He has asked your advice as business...

-

Find the additive inverse, in the vector space, of the vector. (a) In P3, the vector -3 - 2x + x2. (b) In the space 2 2, (c) In {aex + be-x | a, b R}, the space of functions of the real variable x...

-

A manufacturer can sell product 1 at a profit of $20 per unit and product 2 at a profit of $40 per unit. Three units of raw material are needed to manufacture one unit of product 1, and six units of...

-

Under what circumstances might a corporation elect not to carry back an NOL to its prior tax years?

-

What conditions must be met for an accrual-basis corporation to deduct a charitable contribution in a year before it is made?

-

Acorn Corporation is publicly traded on the American Stock Exchange. Its chief executive officer, Carl, currently receives an annual salary of $1 million. The board of directors is considering...

-

what's the answer ABC Corp factors $586,905 of accounts receivable with a financing company on a 'with recourse' basis. The financing company will collect the receivables. The receivable records are...

-

Problems Group A P-F:1-41A. Using the accounting equation for transaction analysis (Learning Objective 4) Meg McKinney opened a public relations firm called Solid Gold on August 1, 2024. The...

-

The following are selected transactions of PT Santorini. PT Santorini prepares financial statements quarterly: (all transactions are in millions) Feb 1 Purchase Merchandise on account from PT Ibiza...

Study smarter with the SolutionInn App