Erna Smith, a portfolio manager, has two fixed-rate bonds in her portfolio: a callable bond (Bond X)

Question:

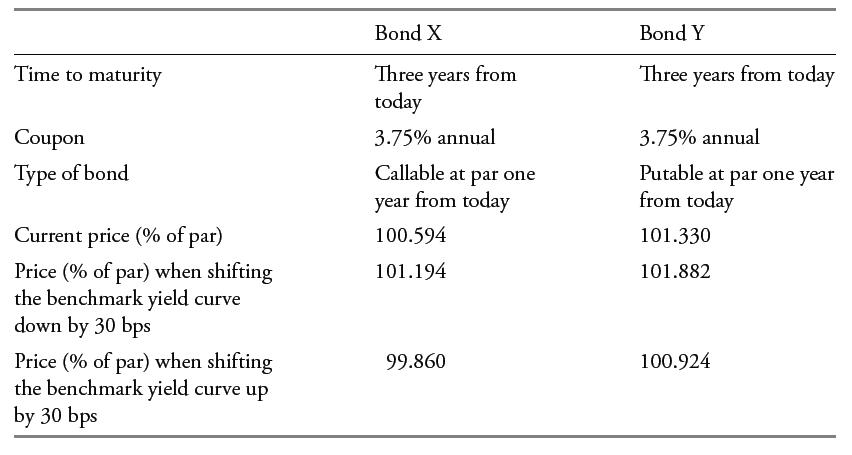

Erna Smith, a portfolio manager, has two fixed-rate bonds in her portfolio: a callable bond (Bond X) and a putable bond (Bond Y). She wants to examine the interest rate sensitivity of these two bonds to a parallel shift in the benchmark yield curve. Assuming an interest rate volatility of 10%, her valuation software shows how the prices of these bonds change for 30 bps shifts up or down: The effective convexity of Bond X:

The effective convexity of Bond X:

A. Cannot be negative.

B. Turns negative when the embedded option is near the money.

C. Turns negative when the embedded option moves out of the money.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: