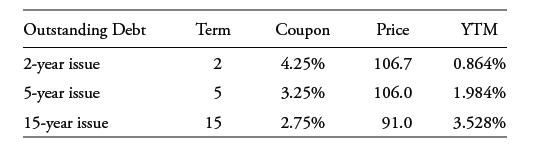

Recall the earlier example of a United Statesbased issuer with the following option-free bonds outstanding: Assume the

Question:

Recall the earlier example of a United States–based issuer with the following option-free bonds outstanding:

Assume the investor instead holds a US$50 million face value position in the outstanding 15-year bond. Historical TRACE data suggest an average $5 million daily trading volume in the 15-year bond. Which of the following statements best describes how the issuer might use an asset swap to manage the benchmark interest rate risk associated with liquidating this bond position?

A. The investor should enter into an asset swap where he receives fixed and pays floating, unwinding the swap position once the bond position is sold.

B. The investor should enter into an asset swap where he pays fixed and receives floating, unwinding the swap position once the bond position is sold.

C. The investor should enter into an asset swap where he pays fixed and receives floating, unwinding the swap position over time in proportion to the amount of the bond sold.

Step by Step Answer: