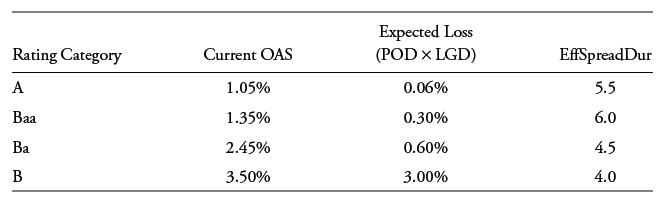

An active credit portfolio manager considers the following corporate bond portfolio choices familiar from an earlier example:

Question:

An active credit portfolio manager considers the following corporate bond portfolio choices familiar from an earlier example:

The investor anticipates an economic slowdown in the next year that will have a greater adverse impact on lower-rated issuers. Assume that an index portfolio is equally allocated across all four rating categories, while the investor chooses a tactical portfolio combining equal long positions in the investment-grade (A and Baa) bonds and short positions in the high-yield (Ba and B) bonds.

Calculate excess spread under an economic downturn scenario for the index and tactical portfolios where both OAS and expected loss rise 50% for investment grade bonds and double for high-yield bonds.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: