Which of the following statements best describes how the expected total return results would change if THB

Question:

Which of the following statements best describes how the expected total return results would change if THB yields were to rise significantly over the investment horizon?

A. Both the Buy-and-Hold and Yield Curve Rolldown expected portfolio returns would increase due to higher THB yields.

B. Both the Buy-and-Hold and Yield Curve Rolldown expected portfolio returns would decrease due to higher THB yields.

C. The Buy-and-Hold expected portfolio returns would be unchanged and the Yield Curve Rolldown expected portfolio returns would decrease due to the rise in yields.

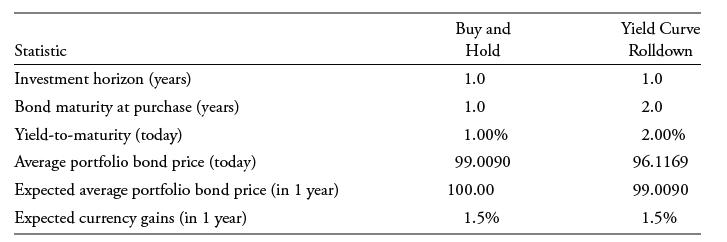

A US-based fixed-income portfolio manager is examining unhedged investments in Thai baht (THB) zero-coupon government bonds issued in Thailand and is considering two investment strategies:

1. Buy-and-hold: Purchase a 1-year, THB zero-coupon bond with a current yield-tomaturity of 1.00%.

2. Roll down the THB yield curve: Purchase a 2-year zero-coupon note with a current yield-to-maturity of 2.00% and sell it in a year.

THB proceeds under each strategy will be converted into USD at the end of the 1-year investment horizon. The manager expects a stable THB yield curve and that THB will appreciate by 1.5% relative to USD. The following information is used to analyze these two investment strategies:

Step by Step Answer: