The rolldown returns over the 1-year investment horizon for the Buy-and-Hold and Yield Curve Rolldown portfolios are

Question:

The rolldown returns over the 1-year investment horizon for the Buy-and-Hold and Yield Curve Rolldown portfolios are closest to:

A. 1.00% for the Buy-and-Hold portfolio and 3.01% for the Yield Curve Rolldown portfolio, respectively.

B. 0.991% for the Buy-and-Hold portfolio and 3.01% for the Yield Curve Rolldown portfolio, respectively.

C. 0.991% for the Buy-and-Hold portfolio and 2.09% for the Yield Curve Rolldown portfolio, respectively.

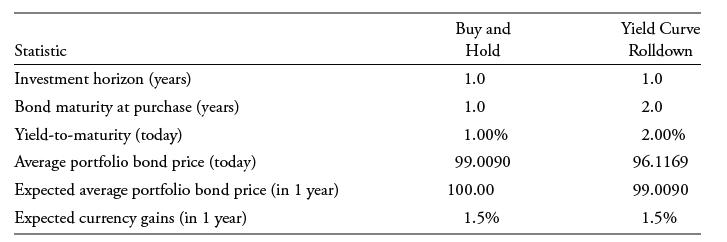

A US-based fixed-income portfolio manager is examining unhedged investments in Thai baht (THB) zero-coupon government bonds issued in Thailand and is considering two investment strategies:

1. Buy-and-hold: Purchase a 1-year, THB zero-coupon bond with a current yield-tomaturity of 1.00%.

2. Roll down the THB yield curve: Purchase a 2-year zero-coupon note with a current yield-to-maturity of 2.00% and sell it in a year.

THB proceeds under each strategy will be converted into USD at the end of the 1-year investment horizon. The manager expects a stable THB yield curve and that THB will appreciate by 1.5% relative to USD. The following information is used to analyze these two investment strategies:

Step by Step Answer: