2. Using the Ratios for Evaluating Financial Progress feature earlier in the chapter, what is Jamie Lees

Question:

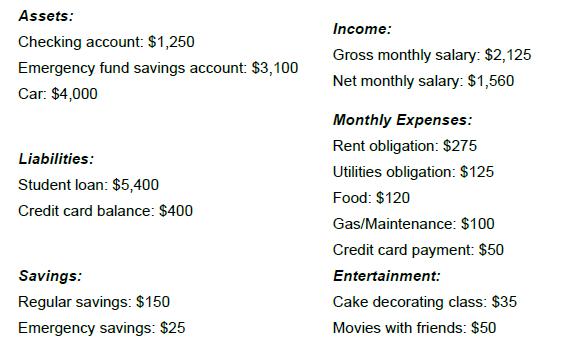

2. Using the “Ratios for Evaluating Financial Progress” feature earlier in the chapter, what is Jamie Lee’s debt ratio? When comparing Jamie Lee’s liabilities and her net worth, is the relationship a favorable one?MANAGING A BUDGET Jamie Lee Jackson, age 24, a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income toward savings, which includes accumulating enough money toward the $9,000 down payment she needs to open her dream cupcake café.

Jamie Lee has been making regular deposits to both her regular and her emergency savings accounts.

She would really like to sit down and get a clearer picture of how much she is spending on various expenses, including rent, utilities, and entertainment, and how her debt compares to her savings and assets. She realizes that she must stay on track and keep a detailed budget if she is to realize her dream of being self-employed after college graduation.

Step by Step Answer:

Focus On Personal Finance

ISBN: 9781259919657

6th Edition

Authors: Jack Kapoor, Les Dlabay, Robert Hughes, Melissa Hart