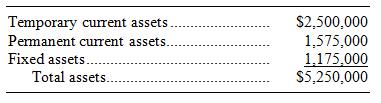

Colter Steel has $5,250,000 in assets. Short-term rates are 9 percent. Long-term rates are 14 percent. Earnings

Question:

Colter Steel has $5,250,000 in assets.

Short-term rates are 9 percent. Long-term rates are 14 percent. Earnings before interest and taxes are $1,110,000. The tax rate is 40 percent.

If long-term financing is perfectly matched (synchronized) with long-term asset needs, and the same is true of short-term financing, what will earnings after taxes be? For a graphical example of perfectly matched plans.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations Of Financial Management

ISBN: 9781264097623

18th Edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

Question Posted: