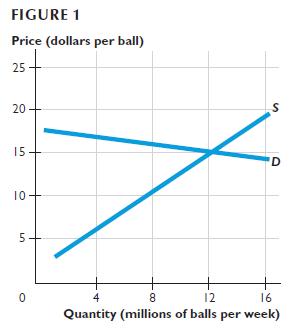

Figure 1 shows the market for basketballs, when basketballs are not taxed. 1. If buyers of basketballs

Question:

Figure 1 shows the market for basketballs, when basketballs are not taxed.

1. If buyers of basketballs are taxed $6 a ball, what price does the buyer pay and how many basketballs do they buy? What is the tax revenue collected?

2. If sellers of basketballs are taxed $6 a ball, what price does the seller receive and how many basketballs do they sell? What is the tax revenue collected?

3. If basketballs are taxed at $6 a ball, what is the excess burden of the tax? Is the demand for basketballs or the supply of basketballs more inelastic?

Explain your answer

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: