Better Health, Inc., is evaluating two capital investments, each of which requires an up-front (Year 0) expenditure

Question:

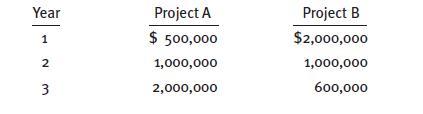

Better Health, Inc., is evaluating two capital investments, each of which requires an up-front (Year 0) expenditure of $1.5 million. The projects are expected to produce the following net cash inflows:

a.What is each project’s IRR?

b. What is each project’s NPV if the opportunity cost of capital is 10 percent? 5 percent?

15 percent?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: