Suppose a firm with a required rate of return or cost of capital of 10 percent and

Question:

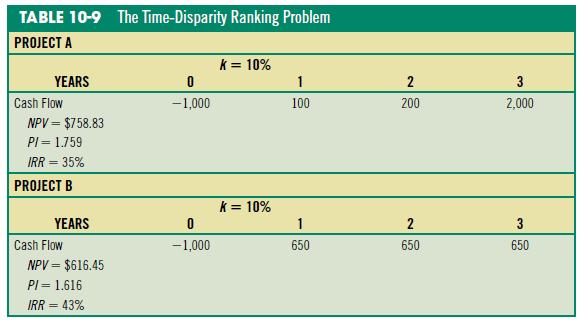

Suppose a firm with a required rate of return or cost of capital of 10 percent and with no capital constraint is considering the two mutually exclusive projects illustrated in Table 10-9. How do we solve this time-disparity problem?

Transcribed Image Text:

TABLE 10-9 The Time-Disparity Ranking Problem PROJECT A YEARS Cash Flow NPV = $758.83 PI = 1.759 IRR = 35% PROJECT B YEARS Cash Flow NPV = $616.45 PI = 1.616 IRR = 43% 0 -1,000 0 -1,000 k = 10% k = 10% 1 100 1 650 2 200 2 650 3 2,000 3 650

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

STEP 1 Formulate a Solution Strategy Which criterion would be followed depends on which reinvestment ...View the full answer

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Foundations Of Finance

ISBN: 9781292155135

9th Global Edition

Authors: Arthur J. Keown, John D. Martin, J. William Petty

Question Posted:

Students also viewed these Business questions

-

CoursHeroTranscribedText: A 5-year loan in the amount of $48,000 is to be repaid in equal annual payments. What is the remaining principal balance after the third payment if the interest rate is 5...

-

Argile Textiles is evaluating a new product, a silk/wool blended fabric. Assume that you were recently hired as assistant to the director of capital budgeting, and you must evaluate the proposed...

-

This case study on project evaluation is applicable for beginning courses in corporate finance or finance strategy. Two alternative investment options are available to evaluate. Challenges are...

-

The accompanying table shows data from the World Bank, World Development Indicators, for real GDP per capita (2010 U.S. dollars) in France, Japan, the United Kingdom, and the United States in 1960...

-

A hyperbolic mirror (used in some telescopes) has the property that a light ray directed at focus A is reflected to focus B. Find the vertex of the mirror when its mount at the top edge of the mirror...

-

1 Assume that a company makes only two products: Product A and Product B. The company's activity-based costing system has allocated $60,000 to an activity called machine setups. It is considering...

-

1 Use Figure 162 to select the advertising media you will include in your plan by analyzing how combinations of media (e.g., television and Internet advertising, radio and yellow pages advertising)...

-

Advanced Automotive pays $210,000 for a group purchase of land, building, and equipment. At the time of acquisition, the land has a current market value of $66,000, the buildings current market value...

-

Andretti Company has a single product called a Dak. The company normally produces and sells 86,000 Daks each year at a selling price of $60 per unit. The companys unit costs at this level of activity...

-

Suppose a firm with a 10 percent required rate of return must replace an aging machine and is considering two replacement machines, one with a 3-year life and one with a 6-year life. The relevant...

-

Suppose a firm is considering two mutually exclusive projects, A and B; both have required rates of return of 10 percent. Project A involves a $200 initial outlay and a cash inflow of $300 at the end...

-

There is a bewildering number of breakfast cereals on the market. Each company produces several different products in the belief that there are distinct markets. For example, there is a market...

-

Canis Major Veterinary Supplies Inc. DuPont Analysis Ratios Value Correct/Incorrect Ratios Value Correct/Incorrect Profitability ratios Gross profit margin (%) 50.00 Correct Asset management ratio...

-

The entrance to Salt Lake City (elevation 3,075 ft at the point of crossing) is grade separated from interstate highway (elevation 3,050 ft at the point of crossing) and will have to be connected....

-

McKnight Handcraft is a manufacturer of picture frames for large retailers. Every picture frame passes through two departments: the assembly department and the finishing department. This problem...

-

A deep reinforced concrete member carries two members with factored loads as shown in Figure 2. Material properties: fy 400 MPa, f'e = 50 MPa. a) Sketch a feasible strut and tie model indicating the...

-

If triangles ABC and DFG are similar triangles and side DF = 218, what is the value of side DG?

-

What is the energy change of this fission reaction? Masses in grams are provided. 241 Pu140 Ba+so Sr+ 111n 241 036 1399106 899077 11 1.00

-

Explain the term global capital markets. This chapter primarily discusses global equity markets. What other types of financial instruments are traded in these markets? How important are global...

-

List and describe key biographical characteristics. How are they relevant to OB?

-

Define intellectual ability. What is the relevance of intellectual ability to OB?

-

Compare and contrast intellectual and physical ability.

-

please help Problem 13-7 (Algo) Prepare a Statement of Cash Flows [LO13-1, LO13-2] [The following information applies to the questions displayed below.] Comparative financial statements for Weaver...

-

A firm has 1000 shareholders, each of whom own $59 in shares. The firm uses $28000 to repurchase shares. What percentage of the firm did each of the remaining shareholders own before the repurchase,...

-

Vancouver Bank agrees to lend $ 180,000 to Surrey Corp. on November 1, 2020 and the company signs a six-month, 6% note maturing on May 1, 2021. Surrey Corp. follows IFRS and has a December 31 fiscal...

Study smarter with the SolutionInn App