22. The Anton Corporation, a manufacturer of radar control equipment, is planning to sell (Impact of new

Question:

22. The Anton Corporation, a manufacturer of radar control equipment, is planning to sell

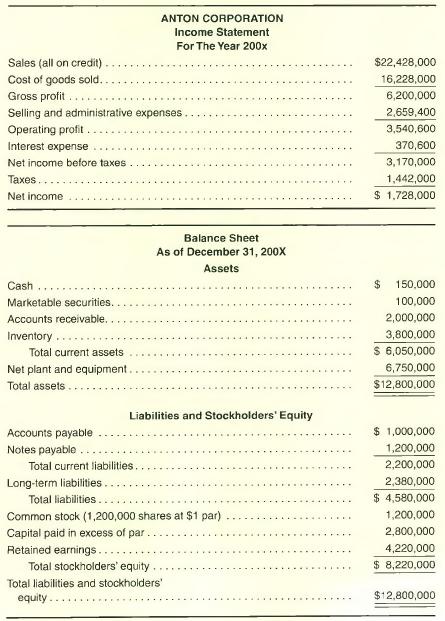

(Impact of new its shares to the general public for the first time. The firm’s investment banker is workpublic offering) ing with the Anton Corporation in determining a number of items. Information on the

(L04) Anton Corporation follows:

The new public offering will be at 10 times the earnings per share.

a. Assume that 500,000 new corporate shares will be issued to the general public.

What will earnings per share be immediately after the public offering?

(Round to two places to the right of the decimal point.) Based on the priceearnings ratio of 10, what will the initial price of the stock be? Use earnings per share after the distribution in the calculation.

Assuming an underwriting spread of 7 percent and out-of-pocket costs of $150,000, what will net proceeds to the corporation be?

What return must the corporation earn on the net proceeds to equal the earnings per share before the offering? How does this compare with current return on the total assets on the balance sheet?

Now assume that, of the initial 500,000-share distribution, 250,000 shares belong to current stockholders and 250,000 are new corporate shares, and these will be added to the 1,200,000 corporate shares currently outstanding.

What will earnings per share be immediately after the public offering? What will the initial market price of the stock be? Assume a price-earnings ratio of 10 and use earnings per share after the distribution in the calculation.

Assuming an underwriting spread of 7 percent and out-of-pocket costs of $150,000, what will net proceeds to the corporation be?

What return must the corporation now earn on the net proceeds to equal earnings per share before the offering? How does this compare with current return on the total assets on the balance sheet?

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9780073382388

13th Edition

Authors: Stanley B. Block, Geoffrey A. Hirt, Bartley R. Danielsen