23. Juans Taco Company has restaurants in five college towns. Juan wants to expand into Austin and...

Question:

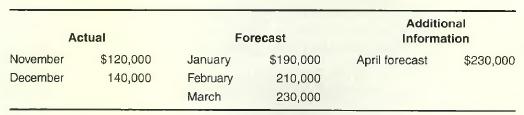

23. Juan’s Taco Company has restaurants in five college towns. Juan wants to expand into Austin and College Station and needs a bank loan to do this. Mr. Bryan, the banker, will finance construction if Juan can present an acceptable three-month financial plan for January through March. Following are actual and forecasted sales figures:

Of Juan’s sales, 30 percent are for cash and the remaining 70 percent are on credit. Of credit sales, 40 percent are paid in the month after sale and 60 percent are paid in the second month after the sale. Materials cost 20 percent of sales and are paid for in cash. Labor expense is 50 percent of sales and is also paid in the month of sales. Selling and administrative expense is 5 percent of sales and is also paid in the month of sales. Overhead expense is $12,000 in cash per month;

depreciation expense is $25,000 per month. Taxes of $20,000 and dividends of $16,000 will be paid in March. Cash at the beginning of January is $70,000, and the minimum desired cash balance is $65,000.

For January, February, and March, prepare a schedule of monthly cash receipts, monthly cash payments, and a complete monthly cash budget with boiTOwings and repayments.

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9780073382388

13th Edition

Authors: Stanley B. Block, Geoffrey A. Hirt, Bartley R. Danielsen