5. The trustee in the bankruptcy settlement for Immobile Corporation lists the following book values and liquidation

Question:

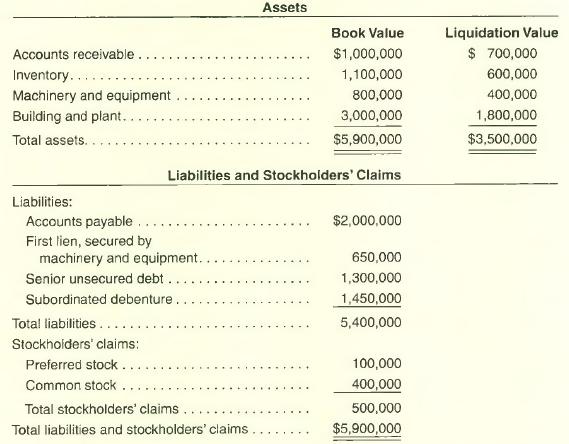

5. The trustee in the bankruptcy settlement for Immobile Corporation lists the following book values and liquidation values for the assets of the corporation.

Liabilities and stockholders’ claims are also shown.

a. Compute the difference between the liquidation value of the assets and the liabilities.

b. Based on the answer to part

a, will preferred stock or common stock participate in the distribution?

c. Assuming the administrative costs of bankruptcy, workers’ allowable wages, and unpaid taxes add up to $300,000, what is the total of remaining asset value available to cover secured and unsecured claims?

d. After the machinery and equipment are sold to partially cover the first lien secured claim, how much will be available from the remaining asset liquidation values to cover unsatisfied secured claims and unsecured debt?

e. List the remaining asset claims of unsatisfied secured debt holders and unsecured debt holders in a manner similar to that shown at the bottom portion of Table 16A-3 on page 524.

f. Compute a ratio of your answers in part d and

e. This will indicate the initial allocation ratio.

g. List the remaining claims (unsatisfied secured and unsecured) and make an initial allocation and final allocation similar to that shown in Table \6A-4 on page 525. Subordinated debenture holders may keep the balance after full payment is made to senior debt holders.

h. Show the relationship of amount received to total amount of claim in a similar fashion to that of Table 16A-5 on page 525. Remember to use the sales (liquidation)

value for machinery and equipment plus the allocation amount in part g to arrive at the total received on secured debt.

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9780073382388

13th Edition

Authors: Stanley B. Block, Geoffrey A. Hirt, Bartley R. Danielsen