7. The equation for the valuation of a supernormal growth firm is: The formula is not difficult...

Question:

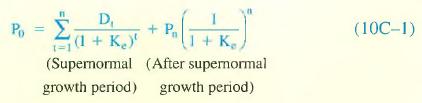

7. The equation for the valuation of a supernormal growth firm is:

The formula is not difficult to use. The first term calls for determining the present value of the dividends during the supernormal growth period. The second term calls for computing the present value of the future stock price as determined at the end of the supernormal growth period. If we add the two, we arrive at the current stock price. We are adding together the present value of the two benefits the stockholder will receive: a future stream of dividends during the supernormal growth period and the future stock price.

Let’s assume the firm paid a dividend over the last 12 months of $1.67; this represents the current dividend rate. Dividends are expected to grow by 20 percent per year over the supernormal growth period (n) of three years. They will then grow at a normal constant growth rate (g) of 5 percent. The required rate of return (discount rate) as represented by Kg is 9 percent. We first find the present value of the dividends during the supernormal growth period.

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9780073382388

13th Edition

Authors: Stanley B. Block, Geoffrey A. Hirt, Bartley R. Danielsen