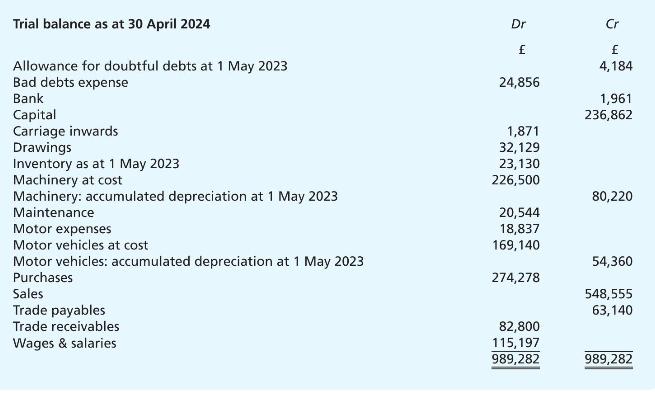

A Danielle is a sole proprietor and you are given the following information relating to her business:

Question:

A Danielle is a sole proprietor and you are given the following information relating to her business:

\section*{Additional information:}

(i) The inventory was counted at 30 April 2024 and was valued at a cost of \(£ 24,010\).

(ii) Depreciation is to be applied at the following annual rates:

Machinery \(20 \%\)

(reducing balance)

Motor vehicles \(25 \%\)

(straight line)

(iii) The amount shown for maintenance on the trial balance includes a payment of \(£ 9,480\) which represents an annual maintenance contract to 30 June 2024.

(iv) Motor expenses incurred for which no invoices have yet been received amount to a total of \(£ 5,348\).

(v) Based on an analysis of the business's experience with debt collection, the allowance for doubtful debts is to be set at \(4 \%\) of trade receivables.

\section*{Required:}

Prepare an income statement for Danielle's business for the year ended 30 April 2024 as well as a balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood