Barchester United (a football club) is negotiating with an Italian club for the transfer of the noted

Question:

Barchester United (a football club) is negotiating with an Italian club for the transfer of the noted player Luciano Gudshotti to the Barchester United team. It is now the start of the new season and you have been asked to advise on the financial aspects of the transfer negotiations.

The average home gate for Barchester is 30,000 people, 30 times a season and the spectator entrance fee is currently £2.50. The present team of 15 players earn on average a total of £6,000 per week (assume a 50-week year) and the existing team has cost £3,200,000 in transfer fees. At present and after all expenses, the Barchester United Football Club makes an annual profit of £150,000.

The directors consider that if an additional £240,000 is spent each year on new promotional activities and with Gudshotti in the team, it will be possible to increase the number of spectators to 33,000 per game and to raise the entrance fee to £3 per person. A new sponsorship deal to be agreed with a local company if Gudshotti joins the club would bring in an additional

£50,000 a year in income.

The Italian club requires a transfer fee of £900,000 of which one half would have to be paid at once, and the balance payable equally in three annual instalments beginning at the end of year 1. Gudshotti requires a four-year contract paying him £50,000 a year plus a signing-on fee

(payable at once on signing the contract) of £200,000. Additionally the rest of the team would expect a 20 per cent pay rise because more will be expected from the whole team in terms of performance.

The cost of capital to Barchester United is estimated to be 14 per cent and the club also expects a payback of not more than three years. You may assume that unless otherwise indicated all costs are to be paid and all revenues received at the end of each year and you are not required to consider the position beyond four years.

Required:

(a) Calculate the payback period over which the proposed expenditure will be recovered.

(5 marks)

(b) Calculate the net present value of the proposal using the discounted cash flow method.

(11 marks)

(c) Calculate the approximate internal rate of return of the proposal. (6 marks)

(d) Advise the directors as to whether or not they should sign Gudshotti and list two other factors which could have an effect on the decision. (3 marks)

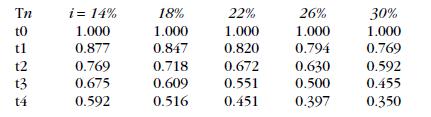

Note: Table of present value factors:

The above table shows the present value of £1 when received at time tn, where n is the number of years before payment is received and i is the rate of interest used in discounting.

Step by Step Answer: