Dunn and Outram sell toys. Their individual investments in the business on 1 January 2018 were: Dunn

Question:

Dunn and Outram sell toys. Their individual investments in the business on 1 January 2018 were: Dunn £160,000; Outram £70,000.

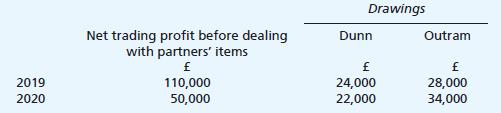

For the year to 31 December 2018, the net profit was £90,000 and the partners’ drawings were:

Dunn £26,000; Outram £32,000.

For 2018 (their first year), the partners agreed to share profits and losses equally, but they decided that from 1 January 2019:

(i) The partners should be entitled to annual salaries of: Dunn £20,000; Outram £30,000.

(ii) Interest should be allowed on capital at 5 per cent per annum.

(iii) The profit remaining should be shared equally (as should losses).

Required:

Prepare the profit and loss appropriation accounts and the partners’ current accounts for the three years.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood