F. Tain is opening his first boutique on 1 July 2002. He is investing 30,000 as capital.

Question:

F. Tain is opening his first boutique on 1 July 2002. He is investing £30,000 as capital. His plans are as follows:

(i) On 1 July 2002 to buy and pay for premises £60,000; shop fixtures £4,000; motor van £8,000.

(ii) To employ two assistants, each to get a salary of £130 per month, to be paid at the end of each month. (PAYE tax, National Insurance contributions, etc., are to be ignored.)

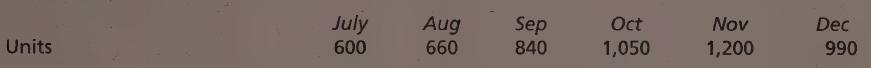

(iii) To buy the following Guaptities of goods for resale (shown in units):

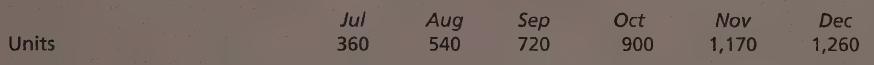

(iv) To sell the following number of units of these goods:

(v) Based on similar ventures in shops selling other products, he has decided to sell all goods at the same price — £30. Two-thirds of the sales are for cash, the other one-third being on credit.

These latter customers are expected to pay their accounts in the third month following that in which they received their goods.

(vi) The goods will cost £7 each for July to October inclusive, and £8 each thereafter. Creditors will be paid in the second month following purchase. (Value stock on FIFO basis.)

(vii) The other expenses of the shop will be £450 per month payable in the month following that in which they were incurred.

(viii) Part of the premises will be sub-let as an office at a rent of £8,000 per annum. This is paid in equal instalments in March, June, September and December.

(ix) His cash drawings will be £1,400 per month.

(x) Depreciation is to be provided on premises at 5 per cent per annum straight-line; shop fixtures at 15 per cent per annum and on the motor van at 25 per cent per annum, both using the reducing balance method.

You are required to:

(a) Draw up a cash budget for the six months ended 31 December 2002, showing the balance of cash at the end of each month.

(b) Draw up a forecast trading and profit and loss account for the six months ending 31 December 2002, and a forecast balance sheet as at that date.

Step by Step Answer:

Business Accounting Uk Gaap Volume 2

ISBN: 9780273718802

1st Edition

Authors: Alan Sangster, Frank Wood