Huge plc acquired a holding of 600,000 of the 800,000 ordinary 1 shares of Large plc on

Question:

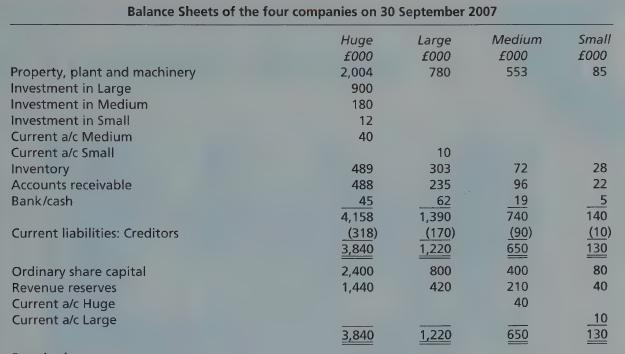

Huge plc acquired a holding of 600,000 of the 800,000 ordinary £1 shares of Large plc on 1 October 2005 when the revenue reserves of Large stood at £320,000.

On 1 October 2006, the directors of Medium plc agreed to appoint the commercial manager of Huge as one of its directors to enable Huge to participate in its commercial, financial and dividend policy decisions. In exchange, Huge agreed to provide finance to Medium for working capital. On the same day, Huge acquired its holding of 100,000 of the 400,000 ordinary £1 shares of Medium when the revenue reserves of Medium were £150,000. Three months later, the directors of Small plc, who supplied materials to Large, heard of the arrangement between Huge and Medium and suggested that they would be pleased to enter into a similar relationship. The board of Huge were interested in the proposal and showed their good faith by acquiring a 10% holding in Small which at that time had a debit balance of £2,000 on its retained profits reserve.

Required:

(a) Identify which of the four companies should be included in a group consolidation, explaining how and why the treatment of one company in the consolidation may be different from another. Mention any appropriate accounting standards or legislation applicable.

(b) Prepare the consolidated balance sheet of the group at 30 September 2007 using the purchase method of accounting.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273712138

11th Edition

Authors: Frank Wood, Alan Sangster