In a new business during its first year of trading (the year ended 31 December 2024), the

Question:

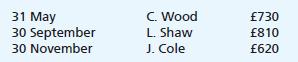

In a new business during its first year of trading (the year ended 31 December 2024), the following debts are found to be bad, and are written off on the dates shown:

On 31 December 2024, the schedule of remaining trade receivables totalling £43,620 is examined and it is decided to make an allowance for doubtful debts of £940.

You are required to show:

(a) The allowance for doubtful debts account and the bad debts expense account.

(b) The charge to the income statement for the year ended 31 December 2024.

(c) The relevant extracts from the balance sheet as at 31 December 2024.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood

Question Posted: