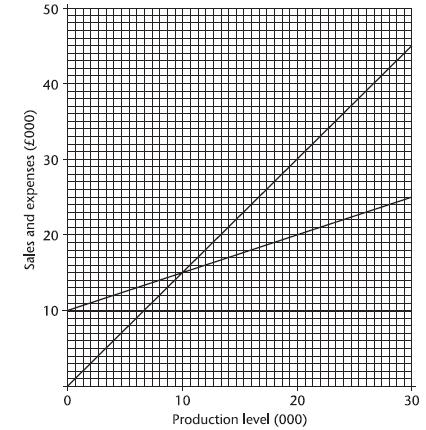

Magwitch Limiteds finance director produced the following forecast break-even chart for the year ending 31 May 20X1:

Question:

Magwitch Limited’s finance director produced the following forecast break-even chart for the year ending 31 May 20X1:

During the year the company produced and sold 20,000 units, and both revenue and expenses were 10 per cent higher than forecast.

Compeyson plc has made an agreed takeover bid for the company at a value of twelve times the net profit for the year ending 31 May 20X1.

Magwitch’s assets and liabilities are to be taken over at their balance sheet values, with the exception of fixed assets, which are to be revalued at £40,000.

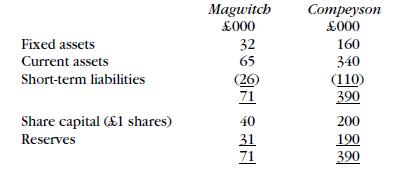

The summarised balance sheets of Magwitch Limited and Compeyson plc at the takeover date of 31 May 20X1 are as follows:

The terms of the takeover are that Compeyson plc will give three of its shares (value £1.80 each) for every two shares in Magwitch Limited, plus a cash payment to make up the total agreed takeover price.

Magwitch Limited will cease to trade on 31 May 20X1, and its assets and liabilities will be assumed by Compeyson plc. Any goodwill arising is to be written off immediately against reserves.

(a) Draw up a summarised profit and loss account for Magwitch Limited for the year ended 31 May 20X1. (5 marks)

(b) Draw up a balance sheet for Compeyson plc after the takeover of Magwitch Limited has taken place. (15 marks)

(c) Calculate how many shares and how much cash would be received by a holder of 6,000 shares in Magwitch Limited as a result of the takeover.

Step by Step Answer: