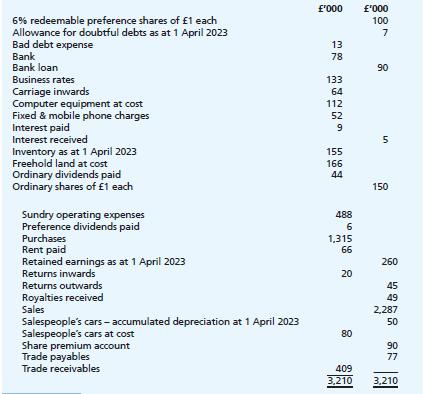

Minellan Ltd has extracted the following trial balance from its nominal ledger as at 31 March 2024:

Question:

Minellan Ltd has extracted the following trial balance from its nominal ledger as at 31 March 2024:

Additional information:

(i) Inventory at 31 March 2024 was counted and valued at a cost of £181,000. Included in this figure, at a cost of £17,000, was damaged inventory. This damaged inventory was sold off cheaply in May 2024 for £5,000.

(ii) In March 2024, the land was professionally valued at £300,000. The directors wish to recognise this current market value in the financial statements.

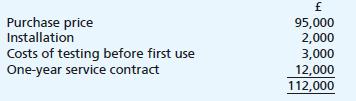

(iii) On 1 November 2023, the company acquired new computer equipment, paying a total of £112,000. This total comprised the following:

The company did not buy any other non-current assets during the year and neither were there any disposals of non-current assets.

(iv) Depreciation is to be provided for the year on the salespeople’s cars at 40% using the reducing balance method and on computer equipment at 25% straight line. The company’s policy is to charge a full year’s depreciation in the year of acquisition and none in the year of disposal.

(v) On 15 March 2024, the company paid its rent for the quarter ending 31 May 2024. However, the cheque for £18,000 has been debited to the business rates account instead of the rent paid account.

(vi) Telephone charges of £8,000 were incurred before the year end but have not yet been accounted for.

(vii) A bank reconciliation as at 31 March 2024 has revealed the following two discrepancies:

• Bank charges of £1,000 appearing on the company’s March 2024 bank statement have been omitted from the accounting records.

• A cheque for £32,000 received from a credit customer on 24 March 2024 has been incorrectly recorded as £23,000.

(viii) Based on a thorough examination of the company’s experience of debt collection, the allowance for doubtful debts is to be set at 4% of trade receivables.

(ix) At the year end the company was subject to a legal action from a former employee who claims she was unfairly dismissed. The legal advisers of Minellan Ltd estimate that there is a 70% chance that the claim will be successful and that the company will have to pay £30,000 as a result, probably within the next six months.

(x) The bank loan of £90,000 was originally received on 1 April 2022 and is repayable in full on 31 March 2027. Interest is paid at a fixed rate of 10% in two annual instalments on 31 March and 30 September.

(xi) The annual dividend on the redeemable preference shares is paid in two equal instalments on 31 March and 30 September each year.

(xii) The corporation tax due on the profit for the year is estimated to be £32,000.

Required:

In a form suitable for publication, prepare the income statement for Minellan Ltd for the year ended 31 March 2024 as well as the balance sheet at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood