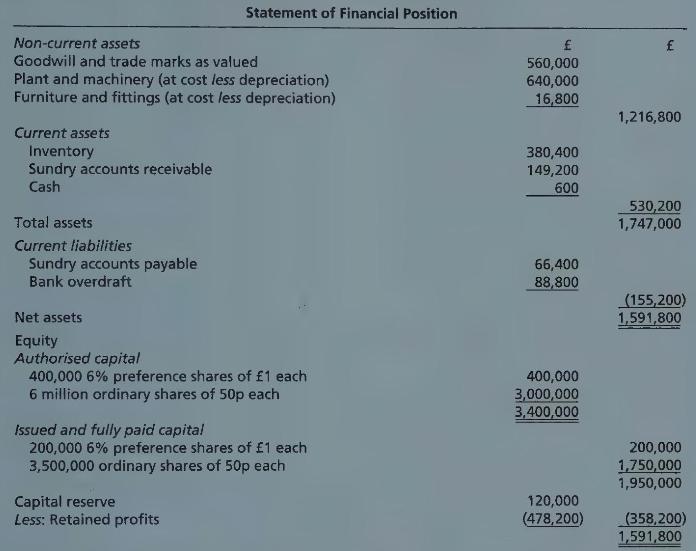

On 31 March 2012, the following was the statement of financial position of Drouthy Yard Ltd: The

Question:

On 31 March 2012, the following was the statement of financial position of Drouthy Yard Ltd:

The following scheme of capital reduction was sanctioned by the Court and agreed by the shareholders:

(a) Preference shares were to be reduced to 80 p each.

(b) Ordinary shares were to be reduced to 25 p each.

(c) The capital reserve was to be eliminated.

(d) The reduced shares of both classes were to be consolidated into new ordinary shares of $£ 1$ each.

(e) An issue of $£ 600,0005 \%$ loan notes at par was to be made to provide fresh working capital.

(f) The sum written off the issued capital of the company and the capital reserve to be used to write off the debit balance of retained profits and to reduce non-current assets by the following amounts:

$\begin{array}{lr}\text { Goodwill and trade marks } & £ 500,000 \\ \text { Plant and machinery } & £ 48,000 \\ \text { Furniture and fittings } & £ 8,800\end{array}$

(g) The bank overdraft was to be paid off out of the proceeds of the loan notes which were duly issued and paid in full.

A further resolution was passed to reduce the authorised capital of the company to $3,500,000$ ordinary shares of $£ 1$ each.

Required:

Prepare journal entries (cash transactions to be journalised) to give effect to the above scheme and draw up the statement of financial position of the company after completion of the scheme.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273767923

12th Edition

Authors: Frank Wood, Ph.D. Sangster, Alan