Reid and Benson are in partnership as lecturers and tutors. Interest is to be allowed on capital

Question:

Reid and Benson are in partnership as lecturers and tutors. Interest is to be allowed on capital and on the opening balances on the current accounts at a rate of 5% per annum and Reid is to be given a salary of £18,000 per annum. Interest is to be charged on drawings at 5% per annum and the profits and losses are to be shared Reid 60% and Benson 40%.

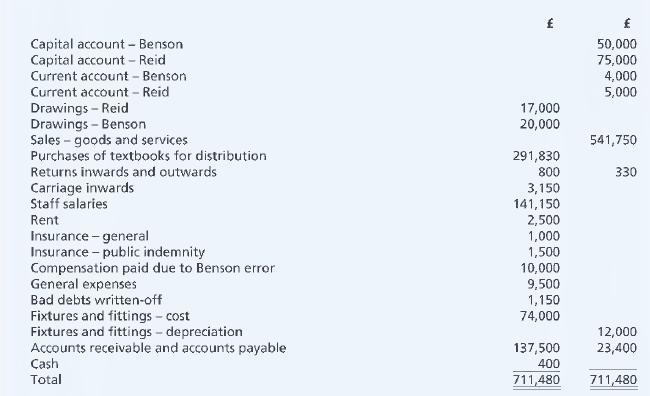

The following trial balance was extracted from the books of the partnership at 31 December 2018:

• An allowance for doubtful debts is to be created of £1,500.

• Insurances paid in advance at 31 December 2017 were General £50; Professional Indemnity £100.

• Fixtures and fittings are to be depreciated at 10% on cost.

• Interest on drawings: Benson £550, Reid £1,050.

• Inventory of books at 31 December 2018 was £1,500.

Required:

Prepare a statement of profit or loss together with an appropriation account at 31 December 2018 together with a statement of financial position as at that date.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9781292084664

13th Edition

Authors: Alan Sangster, Frank Wood