The directors of $mathrm{L}$ Ltd appointed a new sales manager towards the end of 2011. This manager

Question:

The directors of $\mathrm{L}$ Ltd appointed a new sales manager towards the end of 2011. This manager devised a plan to increase revenue and profit by means of a reduction in selling price and extended credit terms to customers. This involved considerable investment in new machinery early in 2012 in order to meet the demand which the change in sales policy had created.

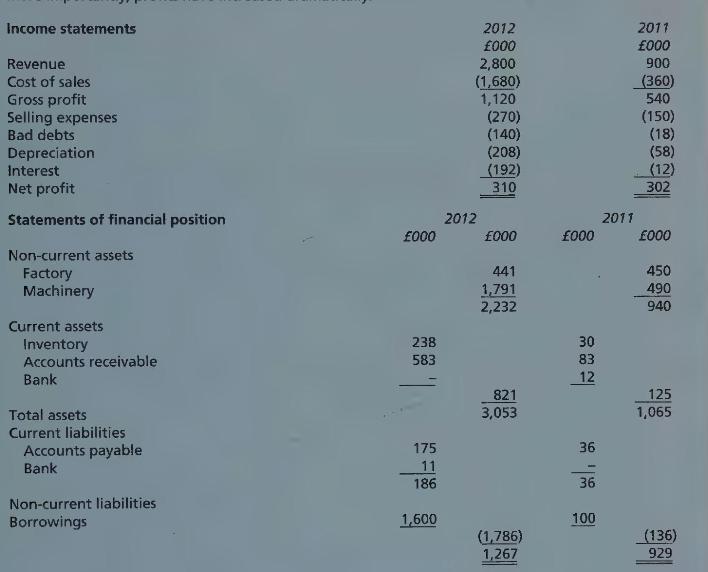

The financial statements for the years ended 31 December 2011 and 2012 are shown below. The sales manager has argued that the new policy has been a resounding success because revenue and, more importantly, profits have increased dramatically.

Note: The balance on the retained profits reserve at the end of 2011 was $£ 327,000$.

(a) You are required to explain whether you believe that the performance for the year ended 31 December 2012 and the financial position at that date have improved as a result of the new policies adopted by the company. You should support your answer with appropriate ratios.

(b) All of L Ltd's sales are on credit. The finance director has asked you to calculate the immediate financial impact of reducing the credit period offered to customers. Calculate the amount of cash which would be released if the company could impose a collection period of 45 days.

(Chartered Institute of Management Accountants)

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273767923

12th Edition

Authors: Frank Wood, Ph.D. Sangster, Alan